When it comes to payment card transactions, there are two key players involved: the card issuer and the card acquirer. Understanding the roles and differences between these entities is crucial for businesses seeking to navigate the complex world of payments.

In this article, we will delve deep into the nuances of the card acquirer and card issuer and clarify their roles and responsibilities.

What is a card acquirer?

The card acquirer, also known as the acquiring bank or merchant bank, plays a crucial role in facilitating credit and debit card transactions between merchants and cardholders' banks. Their primary responsibility is to ensure the smooth authorisation, settlement, and processing of these transactions.

Responsibilities of a card acquirer:

- Facilitating transactions: Acquirers establish and maintain relationships with merchants, enabling them to accept card payments. They provide the necessary infrastructure and technology to securely transmit transaction data for approval and settlement.

- Merchant representation: Acquirers represent the merchant and provide them with merchant accounts. They are authorised to process credit and debit card payments on behalf of the merchant.

- Routing transactions: Acquirers ensure that transactions are routed to the appropriate card network and accept the payment from the issuing bank. They play a crucial role in ensuring that the funds from the cardholder's account reach the merchant's account.

What is a card issuer?

The card issuer, also known as the issuing bank, plays a vital role in the payment card ecosystem by providing credit or debit cards to consumers. They are responsible for managing cardholder accounts, authorising transactions, and ensuring the availability of funds for cardholders.

Responsibilities of a card issuer:

- Issuing payment cards: The card issuer is the financial institution that provides credit or debit cards to customers on behalf of card networks like Visa, Mastercard, Discover, and American Express. They enter into agreements with cardholders and issue payment cards to authorised consumers.

- Managing cardholder accounts: Issuers are responsible for managing cardholder accounts, including setting credit limits, determining interest rates, and implementing security protocols to protect cardholder information.

- Authorising transactions: When a cardholder initiates a transaction, the card issuer plays a critical role in authorising and funding the transaction. They validate the transaction's legitimacy and ensure the availability of funds in the cardholder's account.

- Transferring funds: When a cardholder makes a payment, the funds are transferred from the issuer bank to the acquiring bank (card acquirer). This ensures that the payment is processed, and the merchant receives the funds.

What are the key differences between a card acquirer and card issuer?

The main differences between the two banks are the party they serve, and the role they play in a transaction. One bank operates on the cardholder’s side of the transaction, and the other mainly focuses on merchants who serve them.

Here’s a quick breakdown of some of the key differences the define the issuer vs acquirer dynamic:

|

|

Acquirer |

Issuer |

|

Customer base |

Acquirers primarily focus on establishing and maintaining relationships with merchants, providing them with the necessary tools and support to accept card payments.

|

Issuers concentrate on building relationships with cardholders, offering credit facilities, loyalty programs, and security measures.

|

|

Financial liability |

Acquirers assume financial liability for fraudulent transactions, chargebacks, and operational risks associated with payment processing.

|

Issuers bear the ultimate financial liability for unauthorised transactions, fraud, and credit risk.

|

|

Revenue sources |

Acquirers generate revenue through merchant discount fees, transaction processing fees, and value-added services.

|

Issuers earn revenue through cardholder interest charges, annual fees, interchange fees, and other cardholder-related charges.

|

|

Customer base |

Acquiring banks cater to merchants, offering services that enable these businesses to accept and process (or “acquire”) card payments.

|

Issuing banks serve cardholders, providing them with (or “issuing”) credit and debit cards. |

|

Risk and responsibility |

Acquiring banks manage risks related to merchant transactions; for instance, fraud and chargeback liability. |

Issuing banks bear the credit risk associated with their cardholders. They must ensure that the cardholders are capable of repaying their debts. |

|

Interaction with payment networks

|

Acquiring banks are more involved in the technical and operational aspects of payment processing, including ensuring secure and efficient transaction processing for merchants.

|

Issuing banks interact more directly with cardholders in terms of managing accounts, addressing customer service issues, and ensuring compliance with credit regulations. |

These differences underline the distinct, yet complementary roles that an issuer vs acquirer plays in the payments ecosystem. These positions are vital to ensure that payment transactions can be conducted efficiently.

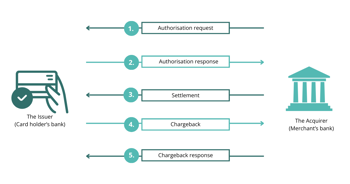

How transactions and chargebacks work: The roles of issuers and acquirers

When it comes to transactions and chargebacks, issuers and acquirers play different, but important roles. Let's break down the steps involved in this process:

- Authorisation request: When a customer makes a purchase using a credit or debit card, the transaction begins with an authorisation request. The merchant sends this request to the acquiring bank (also known as the acquirer) to verify if the customer has sufficient funds and to initiate the payment process.

- Acquiring bank: The acquiring bank is responsible for facilitating payment card transactions on behalf of the merchant. They receive the authorisation request from the merchant and forward it to the issuing bank for approval. Once the transaction is approved, the acquiring bank releases the funds to the merchant's account.

- Issuing bank: The issuing bank is the customer-facing part of the payment chain. They issue credit or debit cards to customers and are responsible for setting credit limits, offering benefits, charging interest and fees, replacing lost or stolen cards, and resolving disputes. The issuing bank evaluates the authorization request received from the acquiring bank and decides whether to approve or decline the transaction.

- Transaction completion: If the transaction is approved, the acquiring bank deposits the funds into the merchant's account, and the customer's account is charged for the purchase.

- Chargebacks: In some cases, customers may dispute a charge on their credit or debit card statement. This can happen if they did not authorise the charge or are unhappy with the product or service received. When a customer initiates a chargeback, they contact their issuing bank to dispute the charge. The issuing bank then investigates the claim and, if deemed valid, initiates a chargeback to reverse the payment. The funds are returned to the customer's account, and the acquiring bank debits the merchant's account for the disputed amount.

- Chargeback management: Acquiring banks and card networks place great importance on payment security and chargeback management. Acquirers receive notice of chargebacks from the issuing banks they work with. If the acquirer cannot resolve the chargeback directly with the issuing bank, they pass it on to the merchant. The merchant then has the option to accept the chargeback or fight it through the chargeback representment process.

It's important to note that chargebacks can have financial implications for merchants. Acquirers may impose fees on merchants with high chargeback rates, and in some cases, terminate their accounts if chargeback rates become too high.

In summary, issuers and acquirers work together to facilitate transactions and manage chargebacks. The acquiring bank handles the payment process on behalf of the merchant, while the issuing bank represents the customer and decides the outcome of chargeback disputes.

Final thoughts

In summary, the card acquirer and card issuer play integral roles in the world of payments. The card acquirer is responsible for processing transactions for merchants and ensuring that the funds are transferred to their accounts. On the other hand, the card issuer acts as the representative of the customer, verifying the card's validity and checking the customer's credit or funds availability.

Understanding the nuances and distinctions between card acquirers and card issuers is paramount for businesses aiming to thrive in the dynamic payments landscape. By grasping the unique roles, responsibilities, and competitive advantages of these entities, businesses can make well-informed decisions, cultivate stronger partnerships, and unlock their maximum revenue potential.