In the fast-paced world of gym and fitness businesses, the ability to manage payments effectively is crucial. With the rapid evolution of digital transactions and the increasing sophistication of fraudulent activities, mastering the art of gym payments is essential for ensuring smooth operations and safeguarding against financial losses and reputational damage.

This comprehensive guide provides valuable insights, actionable strategies, and industry best practices to help UK gym and fitness businesses optimise their payment processes, address relevant trends, and overcome challenges effectively.

Understanding the current landscape within the UK fitness industry

The UK fitness industry has experienced significant expansion, soaring by 4% to £1.8bn in 2023, largely fueled by the integration of digital transformation trends. Gyms and fitness centres are swiftly embracing digital payment methods such as subscription-based models and contactless payments to cater to shifting customer preferences.

Nevertheless, amidst this burgeoning landscape, businesses encounter intense competition from both traditional gyms and boutique fitness studios that provide specialised services. To distinguish themselves, gym and fitness business owners must innovate their offerings and present unique value propositions to attract and retain customers.

What strategies can gym and fitness businesses employ to enhance transactions and safeguard against fraud?

Managing the financial aspects of a gym business involves more than just overseeing revenue and expenses. Gym owners face many challenges, ranging from cost management to ensuring payment security and seamless integration with management systems. In this section, we’ll delve into some of the primary hurdles encountered by gym owners in handling transactions efficiently, along with strategies for overcoming them.

Implementing secure payment systems:

In an era marked by increasing instances of fraudulent activities such as stolen card details and identity theft, the implementation of secure payment systems stands as a crucial priority for gym and fitness businesses.

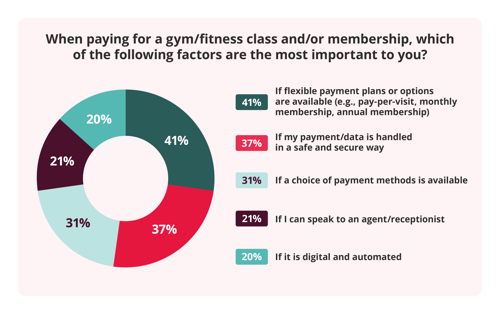

Given the intricate landscape of technology integration, opting for a reputable payment gateway and processor that adheres to industry standards becomes imperative. Our recent survey within the gym and fitness sector revealed that nearly one-fifth (19%) of consumers have experienced inadequate security measures during the handling of their payment information. Moreover, more than a third (37%) emphasised the importance of their payment/data being handled securely when engaging in gym/fitness-related transactions.

Identity verification software can also help to stay ahead of potential threats, by providing a powerful tool to combat fraud effectively while enhancing security and trust.

By authenticating the identity of individuals, this software prevents unauthorised access, fraudulent account creation, and reduces the risk of fraudulent transactions. Integration with payment systems adds an extra layer of security, ensuring that payments are made by verified individuals, thus reducing the likelihood of financial losses or chargebacks.

Moreover, identity verification software helps gyms comply with regulations, enhances operational efficiency by automating verification processes, and includes fraud detection mechanisms to monitor for suspicious activities in real-time.

Compare identification and verification providers

Offering payment flexibility and convenience

Payment trends play a pivotal role in shaping consumer experiences and business operations, particularly in this sector. As the industry undergoes digital transformation, two key trends have emerged prominently: contactless payments and subscription-based models. These trends reflect a broader shift towards convenience and efficiency within the sector.

Contactless payments have gained considerable traction, offering consumers a swift and hygienic payment option, especially in light of recent global events. Similarly, subscription-based models provide customers with hassle-free access to fitness services, fostering loyalty and recurring revenue streams for businesses.

However, despite the rise of these innovative payment methods, our recent survey reveals that the most preferred mode of payment for gym and fitness services remains Direct Debit, with 35% of respondents opting for this approach. This emphasises the necessity for business owners to adapt by implementing robust payment systems capable of offering multi-channel payments.

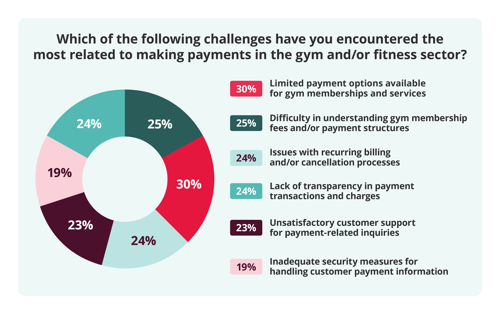

Another consideration is the growing demand for holistic wellness activities, like yoga and meditation, within fitness establishments. Catering to these preferences necessitates adaptable payment methods that offer flexibility and convenience. According to our findings, 30% of respondents identified "limited payment options for memberships and services" as a primary concern when it comes to paying for services in the fitness industry, highlighting the need for diversified payment solutions.

Interestingly, this concern is particularly pronounced among Gen X consumers (aged 43-58), with 35% expressing dissatisfaction compared to 23% of Gen Z individuals (aged 16-26). This demographic discrepancy highlights the importance of offering a wider range of payment options to enhance customer satisfaction and foster loyalty.

To meet the evolving needs of consumers and ensure a superior payment experience, gym and fitness businesses can consider implementing the following strategies:

- Offer a variety of payment options: Provide customers with diverse payment methods such as credit/debit cards, digital wallets, or alternative payment solutions. This allows individuals to choose the option that best suits their preferences and circumstances.

- Implement flexible payment plans: Recognise that customers may have varying financial situations. Therefore, offering flexible payment plans or instalment options can make fitness services more accessible and affordable to a broader audience.

- Focus on convenience and seamlessness: Streamline the payment process by utilising user-friendly interfaces and efficient backend systems. Prioritise convenience to enhance customer satisfaction and encourage repeat business.

By embracing these principles of payment flexibility and convenience, gym and fitness establishments can not only adapt to evolving consumer preferences but also differentiate themselves in a competitive market landscape, ultimately driving growth and success in the industry.

Improve recurring billing and cancellation processes

Our research indicates a pressing need for improvement in recurring billing and cancellation processes, with many consumers wanting the ease of automatic payments or recurring billing for their membership. Almost a quarter of consumers (24%) have encountered issues with recurring billing and/or cancellation processes, while a further 24% report dissatisfaction due to unclear charges and billing discrepancies.

Payment processing software offers streamlined solutions for managing recurring billing, mitigating the risk of issues such as declined payments. Moreover, handling subscription cancellations and refunds becomes more efficient with specialised software functionalities. Through customisable workflows and automated processes, gym owners can streamline these tasks, saving time and resources while ensuring customer satisfaction.

Transparency in payment transactions, another key concern identified among consumers within this industry, can also be addressed through payment processing software. Advanced reporting capabilities and real-time insights enable clearer visibility into charges and billing discrepancies, fostering trust and loyalty among customers.

Additionally, payment processing software offers robust tools for managing chargebacks effectively. With built-in dispute management features and documentation tracking systems, gym owners can navigate chargeback disputes with greater ease and confidence, ultimately minimising financial losses and operational disruptions. By adopting such systems, businesses can mitigate billing-related challenges, cultivate trust among members, and ultimately foster long-term loyalty.

Final thoughts

In the UK fitness industry, mastering the intricacies of gym payments is indispensable for ensuring seamless transactions, staying abreast of industry trends, and effectively tackling challenges. Through a thorough comprehension of industry dynamics, optimisation of payment processes, and implementation of robust fraud prevention measures, gym proprietors can cultivate trust with members and sustain long-term success in a competitive market.

Flexibility, security prioritisation, and consideration for the financial well-being of both the business and its customers are paramount. By adhering to these principles, gyms can thrive while delivering exceptional service and peace of mind to their patrons in an ever-evolving business landscape.

Managing payments and subscriptions has never been easier, allowing us to focus on what truly matters - delivering exceptional fitness experiences to our clients. Thanks to AccessPaySuite, our revenue has skyrocketed, and our administrative burden has significantly reduced. If you're a fitness business looking for a seamless payment solution, I highly recommend AccessPay. It's a game-changer!