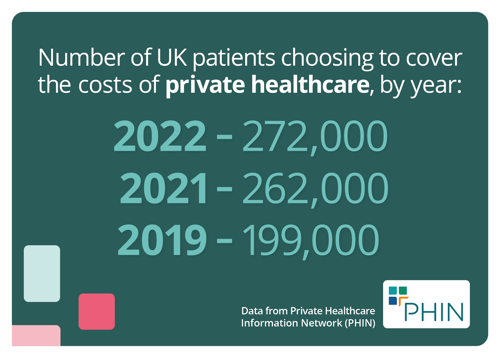

In recent years, there has been a significant uptick in the number of individuals turning to independent medical services in the United Kingdom. This surge, observed across various sectors including health, dentistry, and optometry, is largely attributed to the prolonged waiting times within the National Health Service (NHS). As NHS waiting lists continue to grow, many patients are seeking alternatives to secure timely medical attention, prompting a notable shift towards private provision.

Increasing reliance on private healthcare amid NHS waiting lists:

As the backlog in NHS appointments continues to grow, individuals are seeking alternatives to avoid prolonged delays in accessing essential care. This trend underscores the growing importance of independent health services in bridging the gap between patient needs and available services. The preference for immediacy and efficiency has fueled the growth of the private healthcare sector, with many individuals willing to pay for premium services to bypass NHS waiting lists.

According to recent reports from reputable sources such as the Financial Times and The Guardian, the demand for independent healthcare institutions services has reached record highs, reflecting the frustration experienced by patients awaiting treatment within the NHS.

The backlog in NHS appointments and the subsequent increase in demand for private services can be attributed to several factors. The COVID-19 pandemic has had a significant impact on healthcare systems worldwide, including the NHS. The need to prioritize resources for COVID-19 patients and the fear of contracting the virus have led to delays in non-urgent treatments and a decrease in patient presentations.

Additionally, the NHS has been facing challenges such as large numbers of workforce vacancies, limited access to capital funding, and shortages in key areas like primary and social care. These factors contribute to delayed discharges in hospitals and hinder efforts to address the backlog effectively.

Choice between health insurance and self-funding:

When it comes to private medical care, individuals often find themselves faced with a crucial decision: should they opt for health insurance or self-fund their treatments? Health insurance, while providing financial coverage for medical expenses, often comes with its own set of costs such as premiums, deductibles, and coverage limitations. On the other hand, self-funding allows patients to pay directly for the services they receive, giving them more flexibility and control over their healthcare decisions.

With the increasing availability of transparent pricing models and package deals, individuals now have the power to make well-informed choices about their preferred payment methods.

Within the realm of payment preferences, there is a wide range of options available to patients. One option worth considering is health insurance, which offers individuals the flexibility to access private medical services while spreading the financial burden over time. With health insurance, policyholders can rest assured knowing that they can take advantage of private facilities without having to bear the full cost upfront.

On the other hand, many individuals opt for self-funding as it allows them greater control over their healthcare expenses. By paying for services directly, patients can tailor their treatments according to their budgetary constraints and specific medical needs. For some, self-funding offers a sense of autonomy and independence in managing their healthcare expenses, empowering them to make choices that align with their personal preferences.

Ultimately, the choice between health insurance and self-funding is a personal one that depends on individual circumstances and priorities. Whether individuals choose health insurance for its peace of mind or self-funding for its flexibility and control, the increasing availability of transparent pricing models and package deals ensures that everyone can make informed decisions about their preferred payment method in the realm of private healthcare.

Payment preferences across generations in private healthcare:

Generational differences significantly influence payment preferences in this sector, Baby boomers, who are accustomed to traditional health insurance models, often prioritise comprehensive coverage plans for their security and predictability. On the other hand, millennials and Gen Z individuals, known for their digital inclination and flexibility, are more likely to explore self-funding options and innovative payment models such as Buy Now, Pay Later (BNPL) schemes.

As healthcare expenses continue to rise, the appeal of spreading costs over time has grown among many patients. BNPL schemes, popularised in various consumer sectors, have now made their way into healthcare financing. These schemes allow patients to receive immediate treatment while dividing the associated costs into manageable installments. While BNPL options offer greater accessibility, concerns about potential debt accumulation and long-term financial stability have arisen.

Varying payment preferences across generations

Payment preferences across different generations are influenced by factors such as financial stability, healthcare needs, and attitudes towards insurance. Baby boomers, often equipped with established savings and retirement plans, may lean towards self-funding or comprehensive health insurance coverage to ensure seamless access to medical services in their later years. Generation X, known for their pragmatic approach to finance, may prioritize health insurance as a means of safeguarding against unexpected medical expenses while balancing other financial commitments.

On the other hand, millennials and Generation Z, characterized by their digital savvy and inclination towards flexibility, often exhibit a preference for alternative payment models such as BNPL options. This emerging trend, highlighted in The Guardian's report, underscores the growing acceptance of BNPL schemes in the healthcare sector, particularly among younger demographics facing financial constraints.

The vital role of payment processing providers in bridging generational payment preferences in private healthcare

Payment processing providers play an indispensable role in addressing the diverse payment preferences of different generations within the private healthcare sector. These providers are instrumental in facilitating smooth and efficient financial transactions within the healthcare industry.

Indepdendent healthcare providers face unique challenges when it comes to accommodating the payment preferences of patients from various generations. Each generation has its own distinct inclinations when it comes to how they prefer to pay for healthcare services. For instance, our research indicates that Baby Boomers, the older generation, tend to favor more traditional payment methods such as cash or checks. They are accustomed to these methods and feel more at ease with them. Conversely, Millennials and Generation Z, the younger generations, lean towards digital payment options like credit cards, mobile payments, and online platforms.

This is where payment processing software helps to bridge the gap and ensure a seamless payment experience for both healthcare providers and their patients. These providers offer a wide range of services tailored to the specific needs of non-NHS medical providers practices, enabling them to accept payments through various channels and methods.

In addition to facilitating payments, payment processing providers often offer income management software as part of their services to businesses. This software plays a crucial role in reporting and analytics. By integrating the income management software provided by payment processors, privately-operated healthcare facilities can streamline their financial processes. These platforms consolidate all payment data into a centralized system, regardless of whether the payment was made through traditional terminals, online portals, or mobile applications. This consolidation simplifies the task of tracking and managing finances for healthcare practices.

Furthermore, payment processing software plays a vital role in ensuring the security and confidentiality of financial transactions. Robust security measures are implemented to protect sensitive patient information, ensuring compliance with industry regulations.

The rise of self-funding payments in 2024 reflects a broader shift towards consumer-centric models in the healthcare industry. With increasing numbers of individuals turning to private providers amidst NHS waiting lists, payment choices have become more diversified and tailored to accommodate varying preferences and needs. Whether it's through traditional health insurance plans, self-funding arrangements, or innovative buy now, pay later (BNPL) schemes, patients today have more control over how they access and pay for healthcare services than ever before. However, as the healthcare landscape continues to evolve, it remains crucial to ensure equitable access to quality care in order to address the evolving needs of diverse patient populations.