In today's fast-paced fitness industry, mid-market sized gym and fitness businesses need to offer fast, convenient, and frictionless payment options to meet customer expectations. However, many businesses in this sector sometimes struggle to meet these demands.

Implementing efficient payment processes not only reduces costs but also enhances customer satisfaction and boosts retention rates. These factors ultimately contribute to driving revenue and increasing profits. So, how can mid-market gyms achieve this?

Offer maximum flexibility

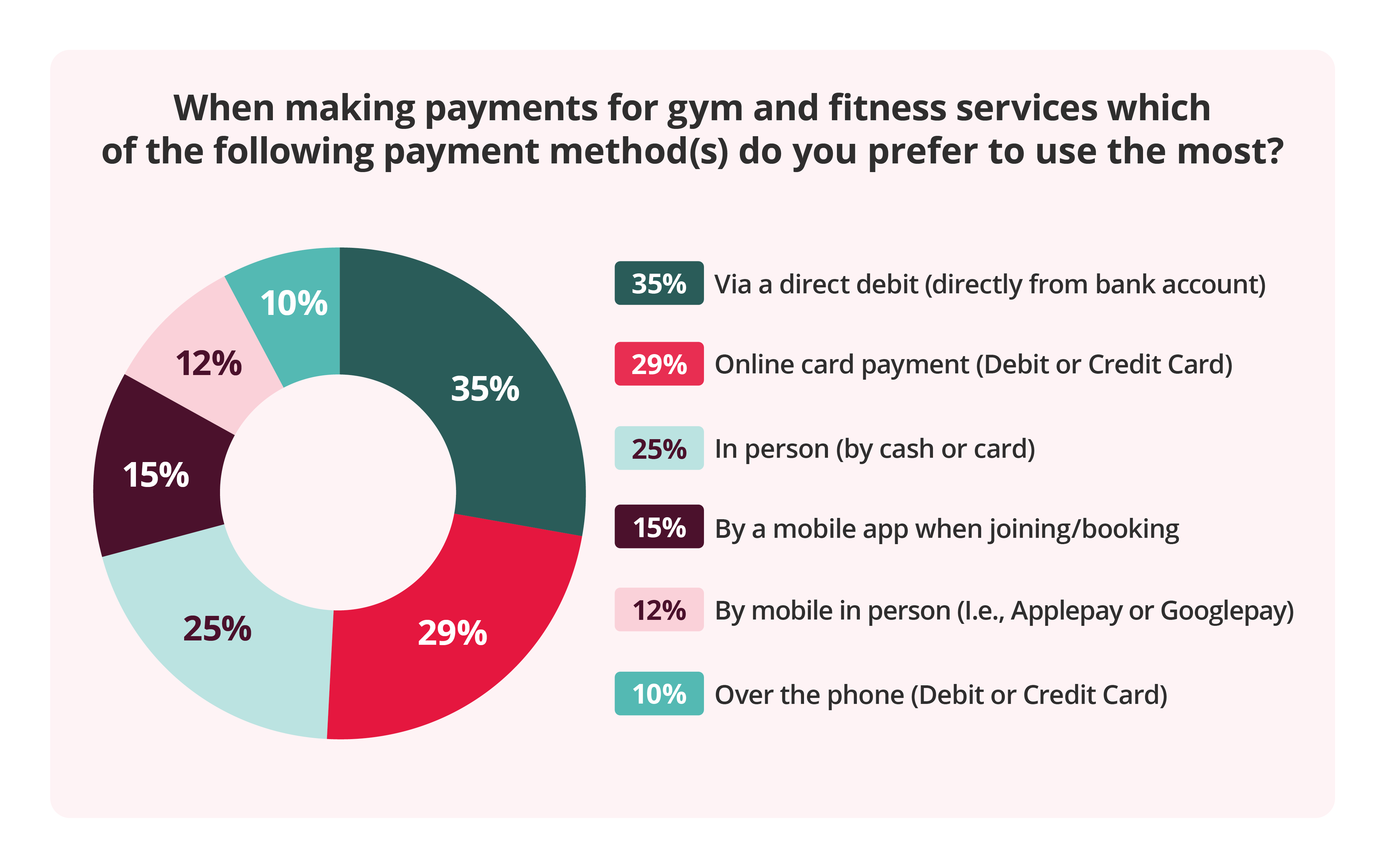

In the dynamic world of the gyms and fitness sector, customers expect more than just traditional cash payments and single card terminals. This is where multi-channel payments come in.

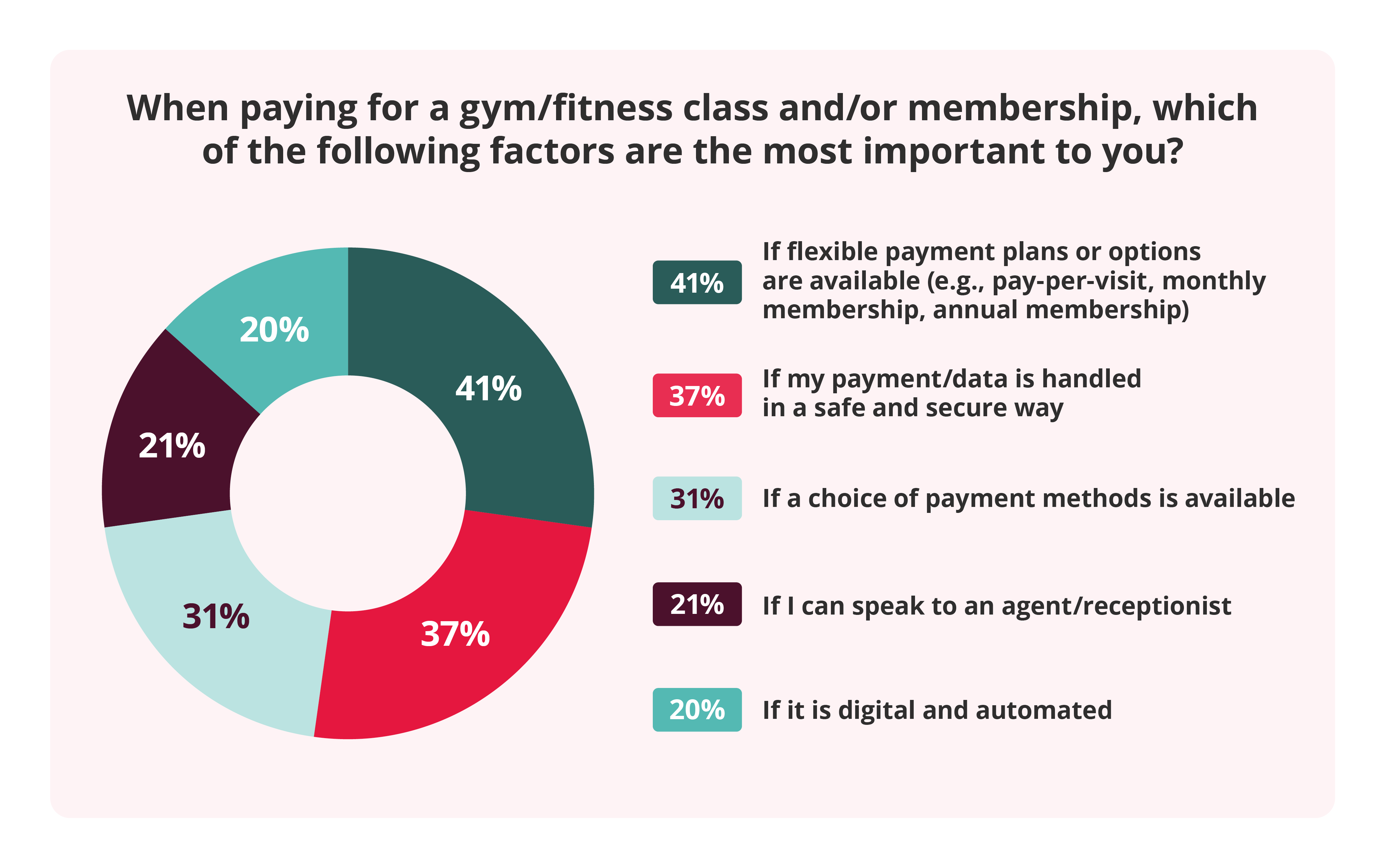

By embracing multi-channel payment processing software, mid-market gym and fitness businesses can offer their customers a variety of options and enhanced flexibility for making quick and easy payments. For instance, customers can conveniently sign up for a monthly membership online, eliminating the need for manual paperwork and saving valuable time for both the business and the customer.

Additionally, payment software for gyms enables businesses to provide customers with the option to set up a Direct Debit within the facility, using a secure link shared via SMS or email.

Adapt to the economic climate

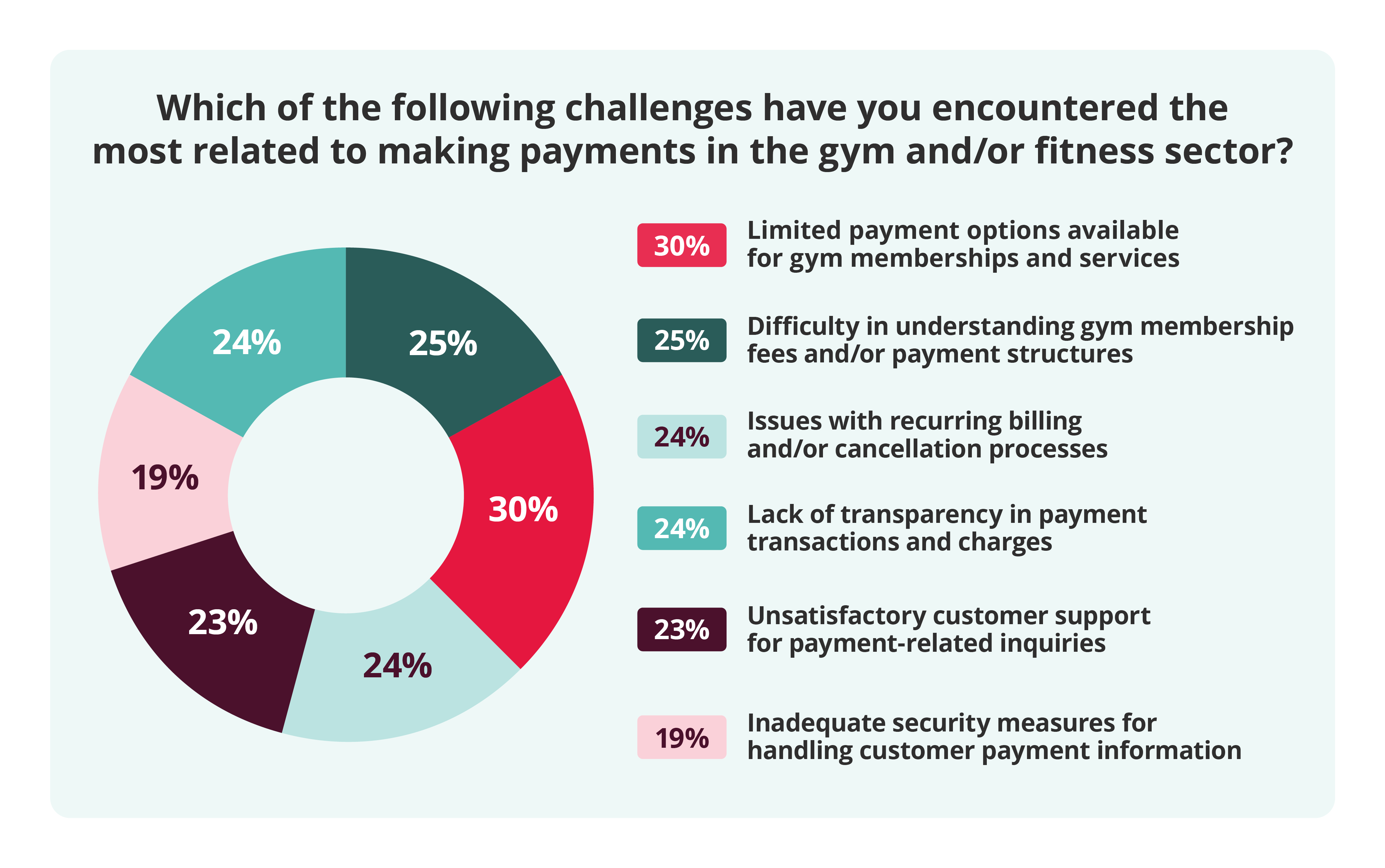

The gyms and fitness sector has been hit hard by the big household income squeeze. In fact, 7% of customers have canceled memberships, while others may be looking to pay in installments or freeze payments. This is why having payment processing systems in place to support flexible multi-channel payment options is critical.

By having reliable payment processing systems in place, mid-market gyms can cater to the financial constraints faced by their customers. Gym payment processing software solutions facilitate flexible multi-channel payment options, whether it's through online payments, Open Banking, or phone payments.

In this challenging economic landscape, the ability to offer diverse payment solutions becomes a strategic advantage. By providing customers with the flexibility they need, businesses can enhance customer satisfaction and loyalty. Furthermore, payment processing systems help empower businesses to navigate the economic challenges while optimizing their revenue streams.

Embrace diverse payment methods to offer digital inclusivity

Despite the rising popularity of digital payments, there are many people who continue to face digital exclusion and encounter challenges in performing basic online tasks daily.

Open Banking, or pay by bank, is rapidly becoming a preferred alternative payment method to paying by card, with over one in nine Brits now using the service. Regulated by the Financial Conduct Authority, Open Banking contributes to digital inclusivity by enabling individuals to make payments more conveniently.

While Open Banking is a great solution, it’s important to consider that some customers will still prefer to pay by phone or in person. By ensuring you have a flexible choice of payment options, those who don’t feel comfortable with digital payments or lack the skills or tools to do so will still have access to a payment method that suits them best, promoting convenience and flexibility.

Explore our Open Banking payments solution

People-first payments for the gym and fitness industry

Aimed at gym and fitness business operators, this guide will break down some of the biggest consumer trends influencing the sector today, and explore strategies to optimise your payments strategy for enhanced customer experience, compliance, and efficiency.

Automate your communication

In the quest to streamline the payment process and elevate the customer experience, automation emerges as a game-changer for gym and fitness establishments. By implementing automated reminders, invoices, and payment confirmations, businesses within the fitness sector can ensure timely and hassle-free payment services, saving valuable time while nurturing stronger customer relationships.

By harnessing the power of automation, gym and fitness establishments can revolutionise their communication strategy. Automated reminders keep customers informed about upcoming payments, reducing the risk of missed payments and enhancing the overall payment experience.

Invoices can be generated and distributed seamlessly using invoicing software, eliminating manual processes and reducing the chances of errors or delays. With automated payment confirmations, customers receive instant notifications, providing them with peace of mind and reinforcing their trust in the establishment.

Stay compliant

Collecting and storing sensitive customer data on a daily basis - health and fitness businesses will already have water-tight data protection policies. Unsurprisingly, the same level of compliance is required to protect payment systems and avoid compromising customers' banking details.

As such, choose a solution that is regulated by the FCA and supports compliance with PCI DSS (Payment Card Industry Data Security Standard) and GDPR. Customers will rest easy knowing their payments are secure.

Final thoughts

The benefits of integrating payment processing software in the gyms and fitness sector are undeniable. Not only does it cater to the evolving expectations of customers, but it also proves to be a strategic move for business growth.

By offering a wider range of payment options, gyms and fitness establishments can attract more customers and enhance customer loyalty. Moreover, the automation and efficiency provided by the software reduce administrative burdens, allowing staff to focus on delivering exceptional experiences and value to their clients.

In conclusion, investing in payment processing software opens up a world of opportunities for gym and fitness businesses. It enables them to meet the ever-growing demands of customers, simplify the payment process, and optimise their operations. By staying ahead of the game and embracing the benefits of multi-channel payments, business owners can position themselves for success in the competitive gym and fitness industry.