Healthcare and wellbeing businesses are operating in an increasingly competitive environment and delivering outstanding payments experiences will be vital to achieve growth.

Transitioning from traditional cash or in-person card payments to a more versatile, multi-channel approach doesn't have to be a disruptive undertaking. Here’s how to maximise the potential of digital, omnichannel or mobile payments to grow your business.

Embrace flexibility

If your business is yet to embrace digital payments, chances are that you have already seen first-hand the need to offer a broader choice of payment methods to your customers – cash payments and a single card terminal on your reception desk no longer meet consumer expectations.

A recent study we conducted found that, while almost a third (32%) of consumers would choose to pay for healthcare and wellbeing services in-person by cash or card, 33% would prefer to pay via an online card payment and more than a quarter (27%) would choose a Direct Debit as their preferred payment method.

The research also shows that generational differences also play a big part in payment preferences. More than one in five Gen Z (those born between 1997 and 2013) consumers would choose to pay via a mobile wallet, compared to just 6% of Baby Boomers (those born between 1946 and 1964). Without offering a wider range of payment options to suit all preferences – whether that’s led by age, or not – you could be losing out on potential business, meaning flexibility is key when it comes to taking payments in the healthcare and wellbeing sector.

Not only does providing a wider range of payment options offer greater flexibility for secure and seamless payments, but this approach also holds the benefit of freeing up staff to allocate their time and attention to other tasks. For instance, allowing customers to make online payments when booking a treatment or appointment, or enabling payments to be taken over the phone without requiring customers to verbally provide their card details, can streamline the process and reduce friction.

People-first payments for the healthcare and wellbeing industry

Aimed at healthcare and wellbeing businesses of all sizes, this guide will break down some of the biggest consumer trends influencing the sector today and explain how to harness your payment systems to improve customer experience, while maintaining compliance and maximising efficiency.

Prioritise digital inclusion

Health and wellbeing establishments such as chemists, opticians and dentists play a vital role in their local communities by offering essential services to support all customers, including those who are not technologically savvy.

Our recent research shows that individuals aged 55 and above showed a preference for in-person payments, with nearly half of the respondents opting for physical card or cash transactions. In contrast, less than a quarter of respondents between the ages of 16 and 24 preferred in-person payments.

To enhance access to digital payments, Open Banking, also known as pay by bank, offers an alternative for customers who may not possess or struggle to use a bank card. This method allows for secure payments directly from their bank accounts.

The October 2023 Open Banking Impact Report found that 11% of British consumers are now active users of Open Banking and the volume of pay by bank payments doubled in the first half of 2023 compared to the first six months of 2022. June 2023 saw a record 9.7m Open Banking payments, an increase of 88% on the same month in 2022.

Simplify compliance

Healthcare and wellbeing businesses will already have data protection policies in place to protect confidential medical records and payments compliance is another non-negotiable to maintain trust with your customers.

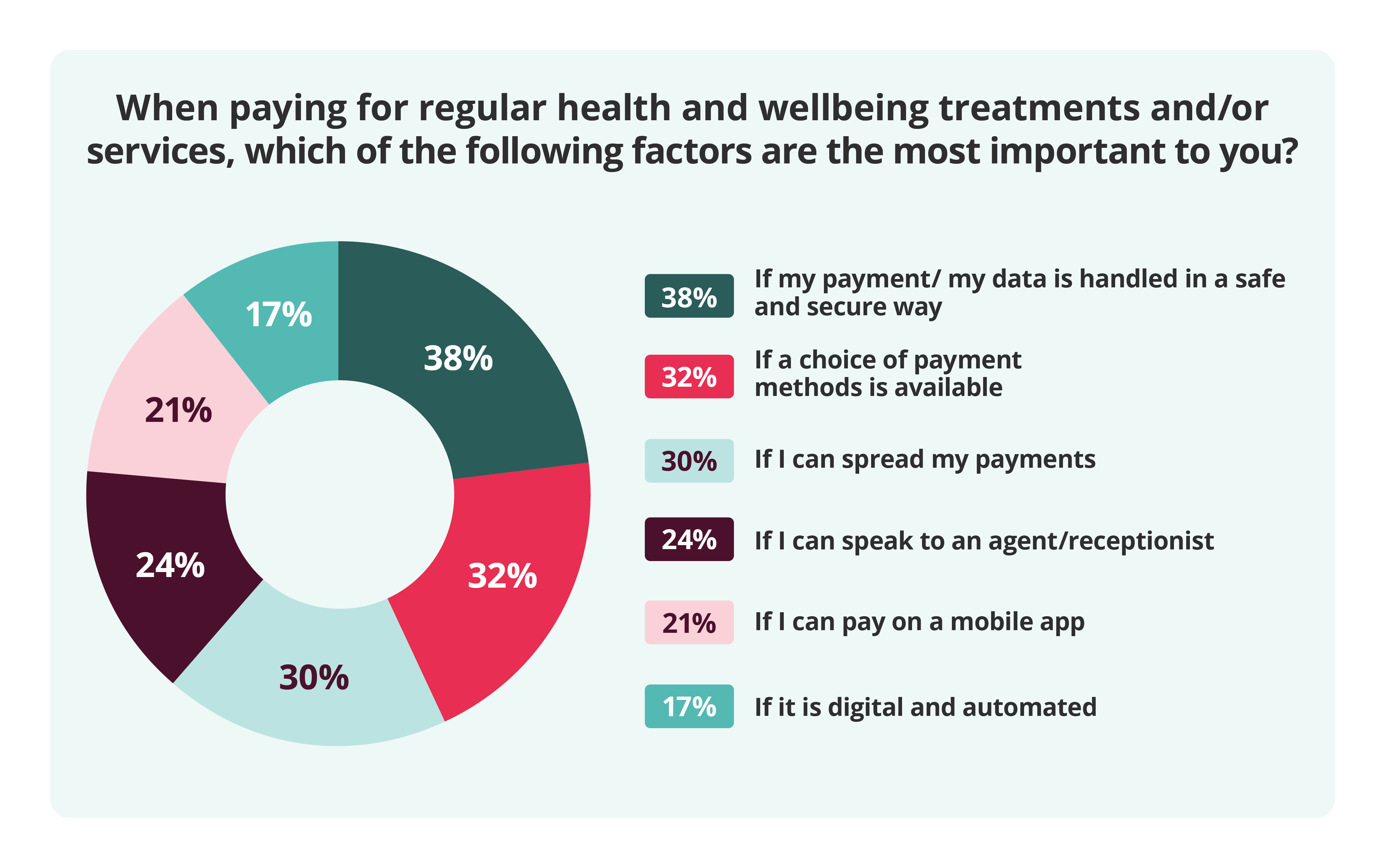

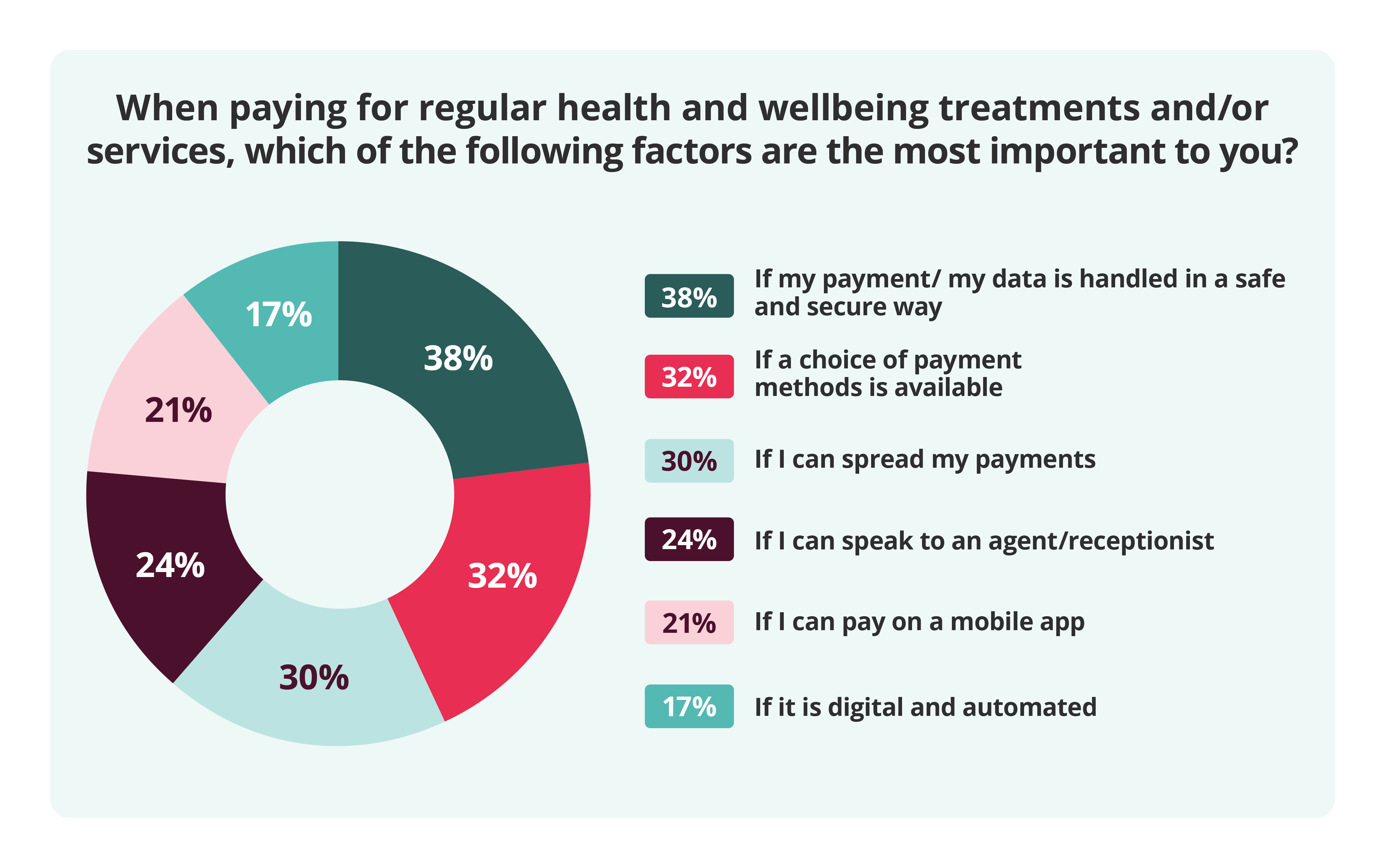

Our recent research also shows that that handling payments in a secure way is the most important decision among consumers when paying for a health and wellbeing product or service. Almost four in ten respondents emphasised the importance of ensuring the safety of their payment and data, which surpassed both the preference for paying through a mobile app (21%) and the desire to have the option to spread payments (30%).

Your customers’ banking details being compromised could have huge repercussions for your business, so choose an FCA authorised provider for your digital payments solution with compliance built-in, covering PCI DSS (Payment Card Industry Data Security Standard) and GDPR.