Customer satisfaction is paramount in any industry to ensure returning custom, but with customer drop off so high in the insurance industry, it is even more important.

As mid-market insurance businesses aim to offer seamless services throughout the policy process, addressing payment friction at the start of the customer journey becomes a crucial priority. A smooth payment experience not only boosts customer satisfaction but also plays a significant role in fostering customer retention and overall business success.

What challenges are encountered by mid-market insurance companies?

In today's fast-paced world, policyholders of all kinds have come to expect convenience at every step, including the payment process. When prospective policyholders encounter obstacles or friction during payments; from issues with data security to customers not being able to pay with their preferred payment method, it can lead to frustration, pose risks to customer acquisition and customer loyalty.

Common challenges include:

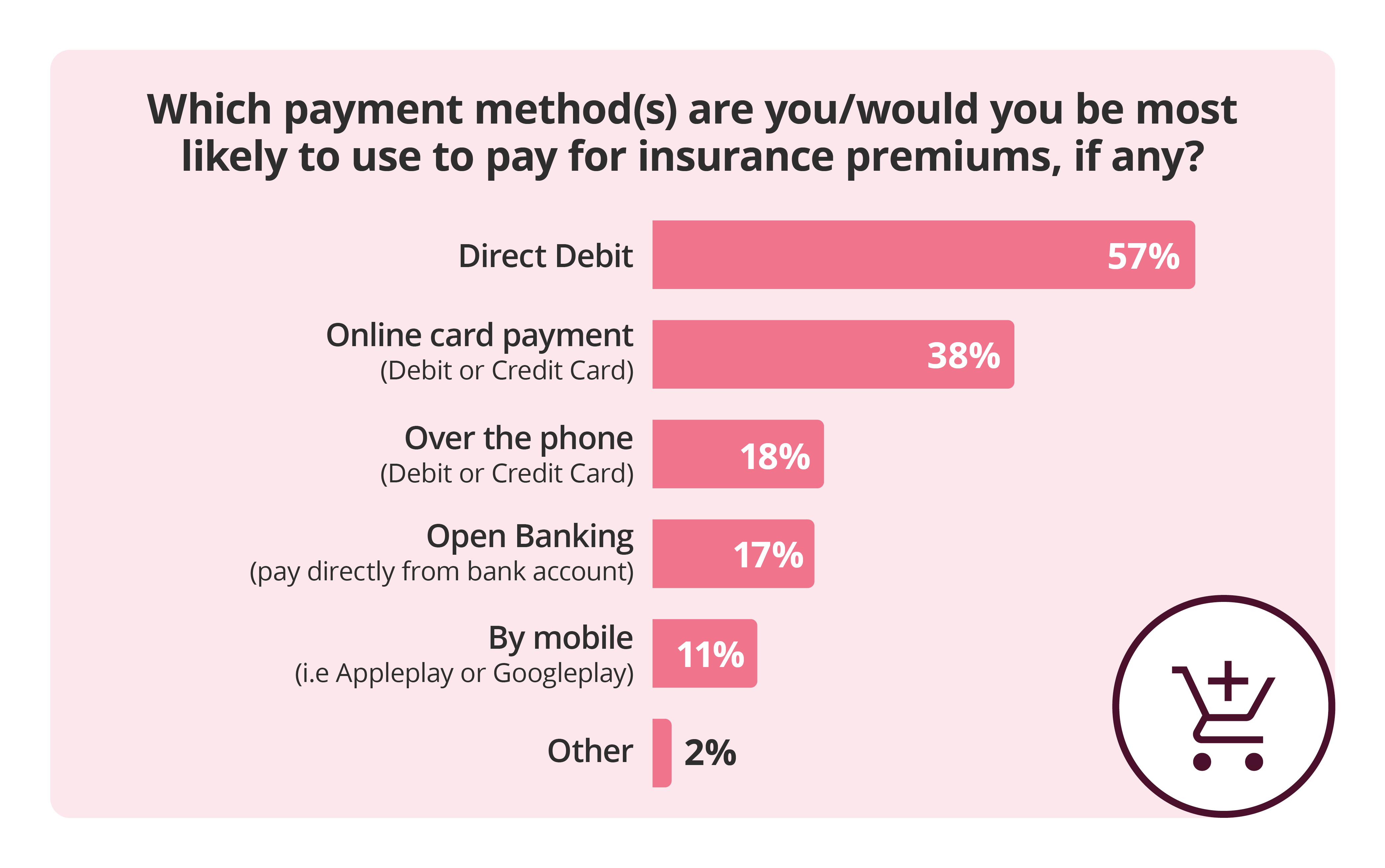

- Limited payment options: Offering a variety of payment methods is crucial, with our research showing that 69% of insurance customers citing flexible payment methods as an important factor to choosing an insurance provider. Potential policyholders may prefer different channels, such as credit cards, bank transfers, or digital wallets. A lack of flexibility can deter potential customers.

- Complex payment processes: Complicated and confusing payment processes can push potential customers away. Making the payment process simple is super important for keeping customers happy and coming back.

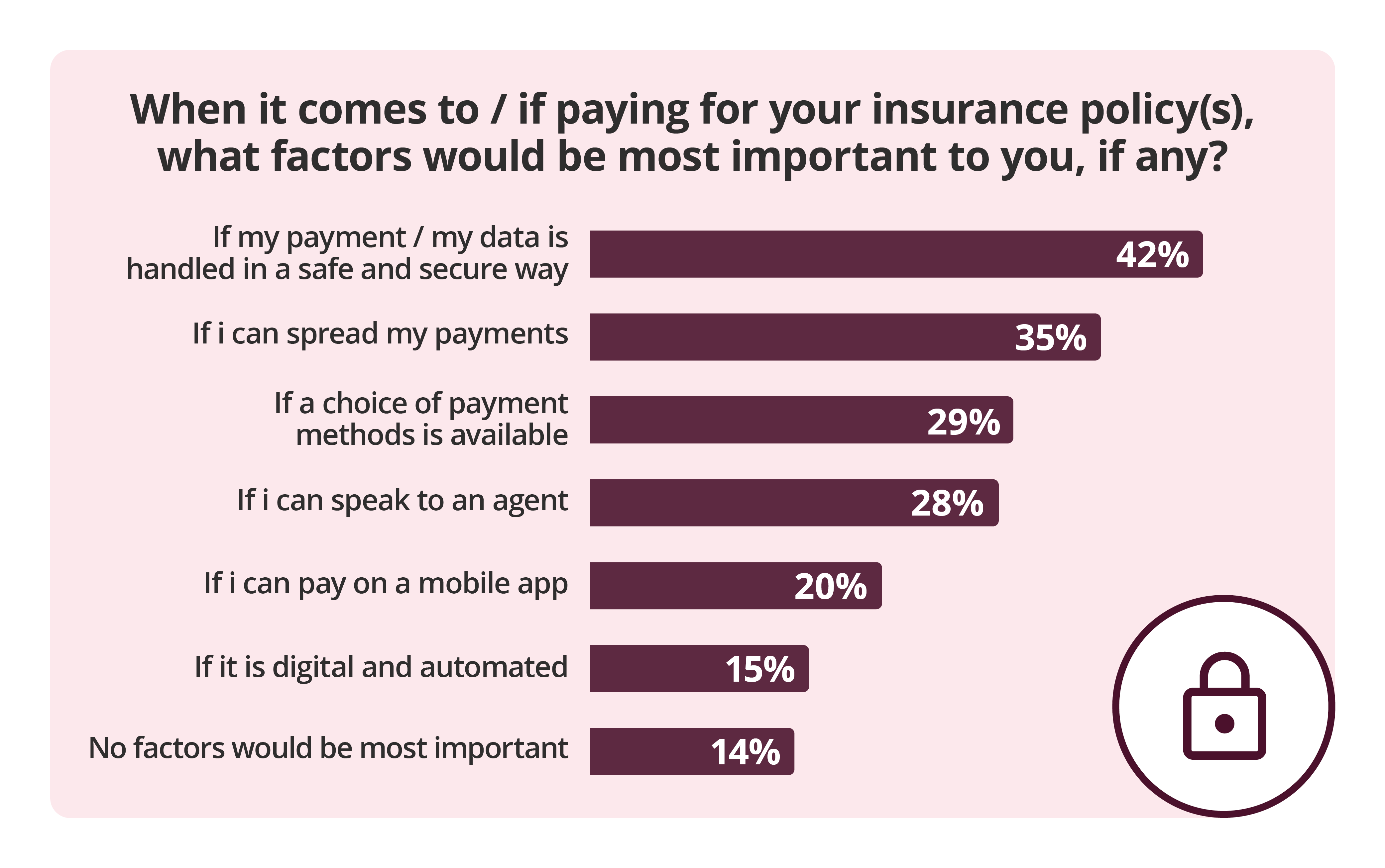

- Security concerns: In an era where data security is paramount, potential policyholders may hesitate to provide sensitive payment information. Research shows that 42% of insurance customers are most concerned about the safety of their data. Implementing robust security measures is vital for building trust and credibility.

Future-proofing payments

in the insurance sector

Specifically tailored for insurance companies and brokers of all sizes, this guide delves into the ever-evolving landscape of consumer trends and behaviors within the insurance sector.

Selecting the ideal payment provider for your mid-market insurance company is crucial in addressing the above challenges. By teaming up with a specialised payment provider, insurers can expand their customer base, future-proof their business, and cultivate positive payment experiences for all upcoming clients.

But how can mid-market insurers be confident that they are partnering with the ideal payment provider for their specific requirements?

- Research the payment options available: A tailored payment provider understands the importance of offering diverse payment options to fit all of your customer base. Whether it's credit/debit cards, bank transfers, or emerging digital payment methods e.g. Open Banking or mobile wallets, providing choices ensures a convenient experience for potential policyholders. Our research shows that 80% of 16-34 year olds would prefer an insurance provider who offers a wide choice of payment options.

- Prioritise user-friendly interfaces: Opt for software that offers an intuitive and user-friendly payment interface to facilitate a seamless online payment process, including a multi-channel user experience such as mobile-responsive design, to enable potential policyholders to make payments with ease.

- Look for enhanced security measures: A reputable payment provider prioritises security. Advanced technologies and secure payment gateways instil confidence in potential policyholders, addressing their concerns about data privacy and fraud. Notably, security and data handling ranked as a top concern for Gen X and Gen Z in our research, only coming second to the ability to spread payments for the generation in-between.

- Seek customisable solutions: Look for a payment provider that offers tailored, customisable solutions to align with the specific needs and branding of mid-market insurers, facilitating a seamless integration into existing systems.

In a competitive insurance landscape, providing a frictionless payment experience is a strategic advantage. By partnering with a specialised payment provider, mid-market insurance companies can not only address the challenges of payment friction but also create a positive impression on potential policyholders. Prioritising a seamless payment process contributes to increased customer satisfaction, loyalty, and ultimately, business success.