The safeguarding of sensitive data is non-negotiable in the ever-evolving landscape of the insurance industry.

As insurance businesses aim for sustainable growth, prioritising data security and compliance in the insurance industry is a strategic imperative. In this era of heightened cyber security threats and increasingly stringent regulations, ensuring the protection of client information is not just a legal requirement, but a crucial component of building trust and sustaining success.

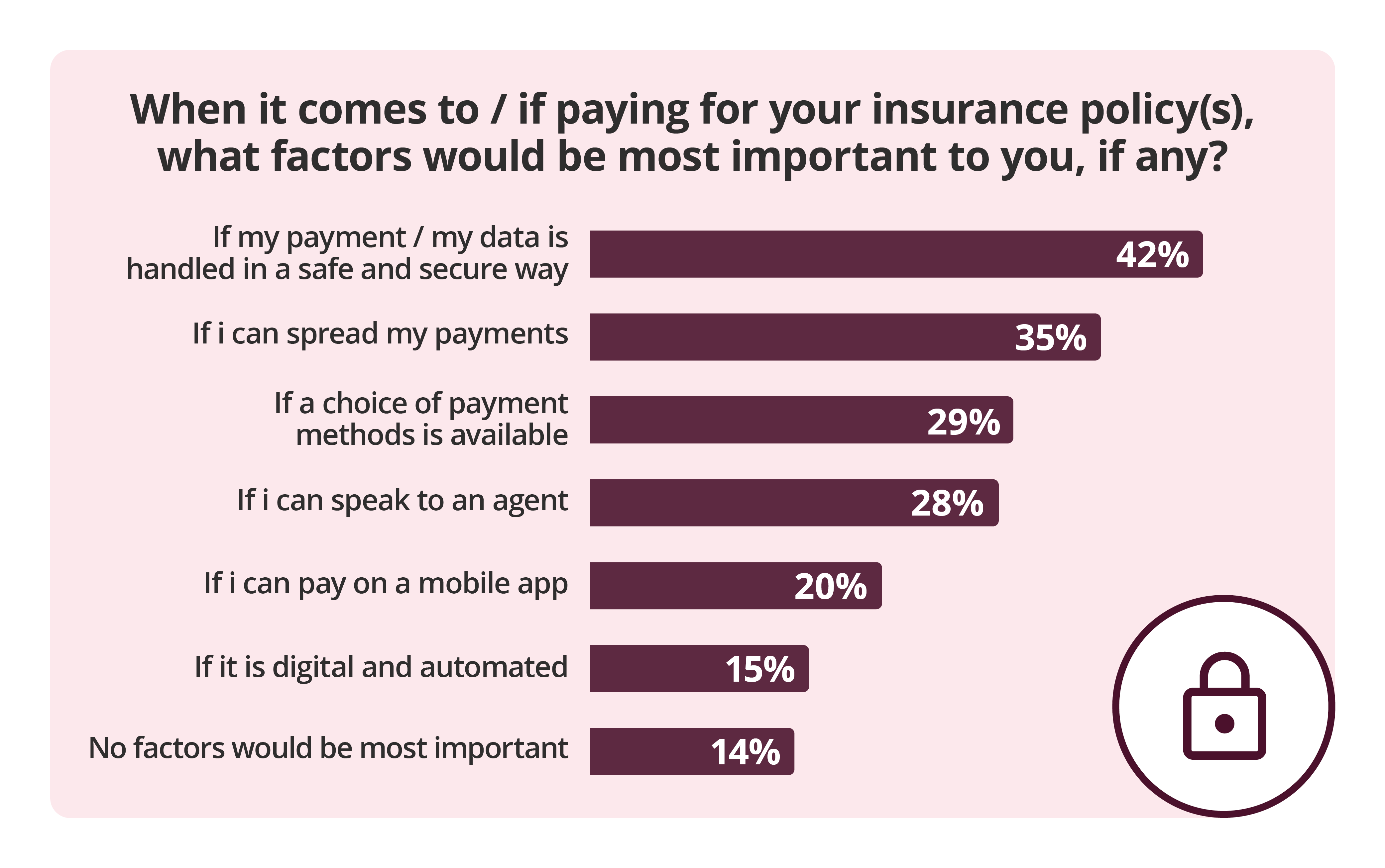

Insurers of all sizes are not immune to the growing risks of cyber threats. From phishing attacks to ransomware, the potential for data breaches is ever-present, and consumers are also aware of these risks. Our research shows that 42% of insurance customers consider data security as their highest priority when choosing an insurance provider. Acknowledging these risks is the first step toward implementing effective safeguards.

In an industry built on trust, a data breach can have severe consequences. Loss of sensitive client information not only jeopardises individual privacy but can also destroy the trust clients place in their insurers. The resulting damage to reputation can be long-lasting and a real challenging to overcome.

Specifically tailored for insurance companies and brokers of all sizes, this guide delves into the ever-evolving landscape of consumer trends and behaviors within the insurance sector.

As data security and privacy regulations continue to evolve, staying informed about industry-specific standards is crucial for insurers. Non-compliance not only leads to legal repercussions but also undermines the business's integrity. Compliance goes beyond box-ticking; it entails fostering a culture of responsibility and accountability. Investing in training programs and internal processes to ensure every team member understands and adheres to data protection protocols is a key aspect of ensuring accountability.

Given insurers' handling of extensive financial transactions and personal data, safeguarding payment information is of utmost importance. The increasing frequency and sophistication of cyber threats necessitate a fortified defense against potential data breaches.

Implementing robust security measures and proactively adhering to industry standards and compliance regulations is vital for protecting payments data and instilling confidence in clients. Embracing secure payments processing software and encryption technologies can enhance the overall security posture of insurance businesses, safeguarding the integrity and confidentiality of payment information. This proactive approach is essential for maintaining trust and upholding the industry's reputation for reliability and security amidst the complexities of data security.

In the ever-evolving landscape of the insurance sector, the significance of a trusted payment processing system in bolstering robust data security cannot be overstated. As insurance providers increasingly turn to digital platforms for processing premiums, claims, and policy renewals, the necessity of a secure payment processing system becomes paramount.

Beyond simplifying payment transactions, a trusted payment processing system provides a secure channel for the exchange of sensitive financial information. By leveraging cutting-edge encryption technologies and stringent authentication measures, such systems act as protection against potential cyber threats and unauthorized access to customer data.

Moreover, in a time marked by diverse payment methods and evolving regulatory standards, a trusted payment processing system offers insurance companies the flexibility to accommodate various payment channels while upholding data security protocols. This adaptability ensures that customer payment information is handled with the utmost confidentiality, fostering trust and loyalty among policyholders.

Safeguarding data security standards within the insurance industry commences with the implementation of robust encryption measures. Collaborating with providers offering state-of-the-art encryption technologies is crucial for protecting sensitive information. Additionally, proactive threat detection and real-time monitoring capabilities, provided by a reliable business partner, are essential to swiftly identify and mitigate potential threats.

Furthermore, a reputable data security partner should demonstrate a profound understanding of the distinct compliance requirements of the insurance sector. Their solutions should be custom-tailored to address these specific needs, providing the assurance that regulatory standards are consistently upheld and surpassed. By forming partnerships with such knowledgeable and adaptable providers, insurers can fortify their defenses and stay ahead of evolving data security challenges in the payments sphere.

In the digital age, data security and compliance are not optional considerations but essential pillars for the success and sustainability of insurance businesses. By prioritising robust data security measures, and compliant business partners, insurers not only protect their clients' sensitive information but also secure their reputation and build a foundation for long-term success.

If you're seeking a trusted partner to enhance your data security and compliance measures, Access PaySuite is ready to assist. Contact us today to explore tailored solutions designed to meet the unique needs of your insurance business.

In this article, we will explore how insurance payment solutions can be the differentiating factor between firms and delve into five key strategies that can help insurers harness the true potential of these solutions to drive value and achieve sustainable growth.

Read more

Insurance companies spend a lot of their time thinking about demographics, particularly life insurers, but this is often purely from a risk point of view, but now more than ever firms need to think about the changing faces of their customers, otherwise they could find themselves behind the curve.

Read more

In any industry, customer satisfaction is crucial for fostering repeat business. However, in the insurance industry, where customer drop-off rates are particularly high, it becomes even more vital. Discover how to deliver seamless services across the policy process and how to tackle payment friction in this blog.

Read the full article