In October 2023, new data published by Open Banking Limited’s Open Banking Impact Report, charted the meteoric rise of Open Banking payments in the UK.

Some 9.7 million payments were made in June 2023, an increase of 88% on the same month in 2022 – with 10.8 million payments made in August 2023. One in nine British consumers and almost one in five (17%) small businesses are now active users of Open Banking – a figure which is expected to grow at a significant pace over coming years.

At Access PaySuite, we recently conducted research into consumer attitudes towards payments in the financial services sector.

Read more: Charting the course: understanding payment trends in the financial services sector in 2024

As part of this, we looked at whether Open Banking payments were available across more than 200 financial services businesses: lenders, building societies, credit unions and fintechs. It was accompanied by a consumer survey of 2,000 consumers across the UK, conducted by Censuswide.

In this article, we will explore the adoption of Open Banking payments across the financial services sector, as well as analysing what more the sector needs to do to meet evolving consumer demands.

What are Open Banking payments?

Open Banking is a widely used term, with a number of applications and definitions depending on the context and industry.

At its core, Open Banking refers to the use of APIs to share financial data and services with third parties. This gives financial service providers secure access to consumer banking, transaction and other financial data held by banks and other financial institutions.

Open Banking payments enable consumers to make secure, quick and easy payments. Unlike a card payment, users don’t have to key in their card details manually or trust a merchant to store them. When making a transaction, you simply need to select your bank from a list and approve the purchase using biometric authentication, such as face ID or fingerprint.

These payments are popular with consumers as they minimise the risk of fraud, as well as the potential for their financial data to be lost or stolen. Perhaps most importantly, Open Banking payments enable consumers to quickly complete their digital payments with ease – with less manual input and a higher chance of payment success.

Businesses are increasingly aware of the benefits too. Open Banking payments are much cheaper than card payments because there are no associated processing costs and, as they are processed via Faster Payments, merchants are able to settle payments instantly, compared to 1 – 3 days for card payments.

How many financial services businesses offer Open Banking payments?

Despite the huge increase in the use of Open Banking across the UK over recent years, the financial services sector is still to see widespread adoption of Open Banking payments.

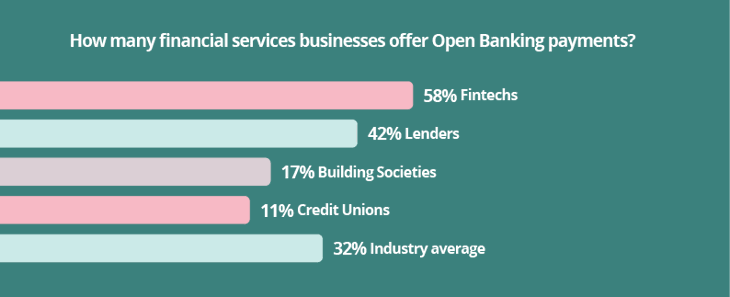

Access PaySuite research into the range of payments offered in the financial services sector shows that just 32% of businesses and institutions currently offer their customers the ability to make payments via Open Banking payments.

What percentage of financial services businesses offer Open Banking payments?

Perhaps unsurprisingly, fintechs lead the way, with 58% offering Open Banking payments among their payment options. Our research shows that Open Banking payments are now offered more widely than Direct Debits (54%) and card payments made over the phone (4%).

With users of fintechs more likely to be younger digitally natives, it makes sense for businesses to prioritise fast, digital payments over in-person support. However, research in the US shows that people under the age of 40 increasingly seek out in-person financial support and advice.

Lenders, building societies and credit unions, by contrast, have been slower to adopt Open Banking payments – with 42%, 17% and 11% of businesses listing the payment option on their website respectively. Businesses across these verticals are more likely to prioritise Direct Debits, standing orders or in-person payments using cash or card.

While these payment methods may be more suitable for their customer bases, it’s increasingly important for financial services institutions to recognise the power of a multi-channel payments offering. The data shows that Open Banking payments are fast becoming a vital component of an effective multi-channel payment strategy.

How are UK attitudes towards Open Banking payments changing?

The survey of consumers we commissioned from Censuswide shows a mixed picture when it comes to Open Banking.

Just over a third (34%) currently use it to make payments for financial services, while 22% would like to do so in the future. Around 16% haven’t used it and are reluctant to and 13% said they’d never use it, while 15% were unsure.

For those aged between 25 and 34, this figure rises to almost half (46%) of respondents that had used Open Banking to make payments. Just 5% of this age group would never use Open Banking to make payments.

As consumer awareness of the availability of Open Banking payments increases, our research shows that its key benefits are likely to power a further growth in popularity. The survey found that confidence that payments will be handled securely was an important consideration influencing the choice of financial services provider for 40% of respondents.

This figure is higher than the ability to spread payments (23%), a choice in payment methods (28%) and the ability to pay in app (37%).

What do financial services businesses need to know about Open Banking payments?

Research from Access PaySuite, as well as wider industry figures, show that financial services businesses need to recognise the rising popularity of Open Banking payments.

Choice and flexibility will continue to be a vital consideration for consumers, who increasingly value the ability to choose the most effective payment option for their circumstances and type of transaction. This is why many financial services businesses already adopt multi-channel payment options – whether that’s the ability to pay in-person using card, cash or cheque, recurring Direct Debits or standing orders, or online using card or a digital wallet.

As businesses in the financial services sector consider the most effective payment options to offer their customers, Open Banking payments cannot be ignored. Consumers and businesses alike value the ease and speed of payments using Open Banking APIs, while the added security and authentication provide additional trust and confidence.

Find out how Access PaySuite can help you to future-proof your payments processes.