Understanding transaction trends and the growing importance of Direct Debits

Recent data reveals notable fluctuations in monthly transaction values across various sectors, particularly in essential services like electricity and gas. Here, transaction amounts remain consistently high, emphasising stable customer bases and dependable revenue streams.

Direct Debits continue to gain traction

Direct Debits continue to gain traction, with average transaction values rising by nearly 3% since January 2019, reaching £309.41 by the end of 2024. This growth reflects a deepening trust in Direct Debit as a dependable option for recurring payments, especially in utilities and mortgages. Our consumer research underscores this trend, with convenience and reliability making Direct Debits the go-to payment method for many households and businesses alike.

Sector-specific insights and payment trends

Utilities: Navigating volatility

The electricity and gas sectors are grappling with mounting challenges, with failure rates climbing from 0.9% to over 2% in recent years. This trend, alongside fluctuating transaction amounts (peaking at £207.21 in 2023), highlights the critical need for robust management systems to handle cost variations and ensure consistent collections.

Water utilities demonstrate distinct seasonal payment patterns, with usage typically spiking in March and September. These periods often result in larger payments due to increased consumption, particularly during warmer months.

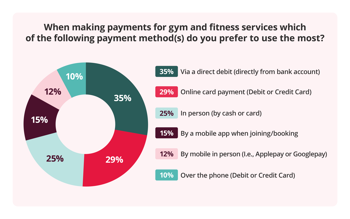

Fitness facilities: Adapting to change

The fitness sector experienced significant turbulence during the COVID-19 pandemic, with failure rates rocketing to 19.44% in January 2021. As the industry rebounds, there's a clear opportunity to enhance Direct Debit solutions, which 35% of consumers prefer for spreading payments throughout the year. The sector remains characterised by low average transaction values (typically under £30) and high sensitivity to seasonal shifts and economic disruptions.

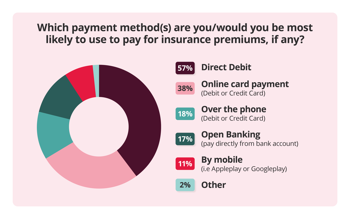

Financial services and insurance: Direct Debit dominance

In both insurance and financial services, our recent research shows that Direct Debit remains the payment method of choice:

- Insurance:

57% of consumers prefer Direct Debit for premium payments

- Loan payments:

52% favour Direct Debit

- Mortgage repayments:

70% choose Direct Debit

- Private pension contributions:

41% opt for Direct Debit

Financial service providers contend with failure rates between 2-4%, with average transaction values fluctuating from £152 to £330. Direct Debit provides a reliable mechanism for managing cash flow and mitigating payment failures in this volatile landscape.

Payment failures: A cross-sector challenge

Payment failures continue to pose a significant challenge across industries:

- Utilities:

Electricity and gas failure rates have more than doubled, with water utilities experiencing increases during peak billing periods.

- Financial Services:

Loans demonstrate the second-highest failure rates (2-4%), with recent dips in transaction values potentially indicating borrower pressures.

- Fitness:

Particularly vulnerable to economic shifts, with failure rates approaching 20% during the pandemic.

Seasonal patterns further complicate the landscape, with January typically seeing heightened failure rates due to post-festive financial strain. Understanding these nuanced dynamics is crucial for developing strategies to minimise payment failures and optimise Direct Debit processes, ultimately enhancing financial stability and customer satisfaction in 2025 and beyond.

Strategies for success: Mitigating payment failures and future-proofing your business

To effectively address payment failures and navigate the evolving landscape, businesses should consider implementing the following strategies:

Short-term strategies

- Regular monitoring of transaction data: Continuously analyse transaction data to identify patterns and anomalies

- Enhanced customer communication: Engage proactively with customers, especially during high-risk periods, and provide clear information about payment schedules

- Provide educational resources: Help customers better understand processes like Direct Debit to reduce confusion and potential failures

Long-term strategies

- Flexible payment options: Offer multiple payment methods and customisable schedules to cater to diverse customer preferences

- Robust payment processing systems: Invest in reliable technology capable of handling high transaction volumes and offering advanced features like real-time monitoring

- Leverage data analytics: Utilise payment behavior data to optimise collection strategies and predict potential issues

- Focus on sustainability: Implement paperless mandates and digital documentation to reduce environmental impact and streamline processes

Actionable steps

- Conduct a thorough review of your current payment systems and identify areas for improvement

- Develop a comprehensive communication strategy to keep customers informed about their payment obligations and options

- Invest in staff training to ensure your team can effectively manage and troubleshoot payment processes

- Regularly review and update your payment strategies to adapt to changing customer needs and technological advancements

By implementing these strategies, businesses can work towards reducing payment failures, improving customer satisfaction, and building a more resilient payment ecosystem for the future.

The Direct Debit landscape is poised for continued growth and transformation as we move into 2025. Businesses that adapt to changing economic conditions, embrace technological advancements, and prioritise customer-centric approaches will be best positioned to thrive. By leveraging insights from recent data and adopting proactive strategies, organisations can enhance their financial stability and customer satisfaction while establishing themselves as leaders in the Direct Debit space.

Ready to set up fast and simple Direct Debit payments?

We’re here to help – set up fast, reliable Direct Debit payments with expert support. Get in touch today and let our team guide you every step of the way.