For years now there has been an increasing desire for utility company billing departments to go completely paperless.

It is understandable of course; paperless billing has so many advantages, not the least of which is reduced costs, but not everyone is so sure.

So will we ever see a truly paperless utility company? And what exactly are the barriers to going totally digital?

What do we mean by ‘paperless’?

‘Paperless’ is such an amorphous term that it is difficult to truly understand what we mean by it. Are we suggesting that the utility company would have no paper whatsoever?

Or does paperless mean that just the billing and statement cycles are run digitally with other functions still retaining traditional methods?

For the purposes of this article, we’re going to take a fairly relaxed view. Yes, the majority of the tasks such as billing, statements, payments and communications in the truly paperless office would be digital, but that doesn’t mean that there will be strictly no paper anywhere!

So will we see a truly paperless utility company and will all utility providers become paperless over time?

Internal digitisation

The starting point for digitisation in any business has to be the internal processes the company uses.

It’s easier to digitise internally as pretty much all of the variables are under your control.

To be fair, most utility businesses have a high degree of core digitisation and systems such as Microsoft Teams have helped in this regard.

But it is also true to say that it is still possible to see teams using clipboards with work orders and other internal control documentation in paper form and this perhaps highlights a key difference between different businesses in the utility sector.

Some companies are retail only and it is much easier to digitise their operations. They only sell to retail consumers and don’t deal with the generation or supply side. Other companies deal with almost the whole value chain and can be involved in billing consumers, providing a connection for a business or digging up the roads to repair a connection.

Going paperless may be easier for some than others.

The argument goes that it is not cost effective to provide people who are working in the field with tablets and mobile devices, however the increase in efficiency offsets any costs here. One incorrect work order resulting in the repair of a non existent fault could pay for a year’s worth of mobile devices.

It is true that in some cases connectivity will be patchy but with the rollout of 4G and 5G and greater access to satellite connectivity this argument is becoming less powerful.

Perhaps the only reason that we haven’t seen every internal process digitised is simply that the case hasn’t been made strongly enough in all companies.

External digitisation

For a number of years traditional utility companies have been encouraging their customers to use paperless methods to interact.

Digital accounts, Direct Debits and emailed billing have all combined to reduce costs and increase efficiency.

Indeed, the new wave of energy companies in the UK are almost all digital based.

Companies such as Pure Planet have a digital only customer service function and that doesn’t seem to have hurt their brand as they have been selected as a 2021 Which? Recommended Provider (WRP), an accolade that fellow newbie Octopus has won for the last four years.

Newer companies have made paperless operations a central part of the offer, concentrating on providing great customer service to enhance their reputation.

Of course this is easier for retail only businesses and companies that are small and do not have legacy systems. It is a much harder prospect for businesses that also deal with supply and have hundreds of thousands of customers.

To a great extent the digitisation of external customer interaction is limited to the amount of customers that want to go paperless. This means that companies have to give them good reason but also that the customers need to be connected to the web and able to use the systems in the first place.

Who is more likely to go paperless?

There’s a strong argument that the only reason that there are any paper interactions with customers is one of demographics.

People without internet access simply have to use paper billing which means that utility companies are almost forced to use this option.

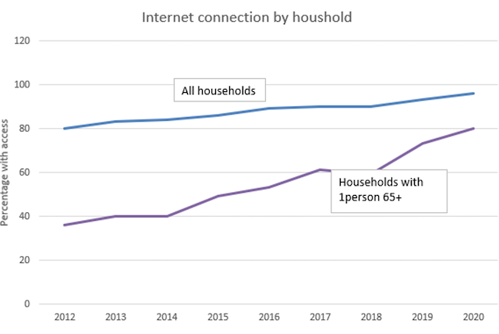

However, the number of households with internet access has been steadily rising over the last 20 years to a point where some subsets of society have near 100% connectivity.

The least likely to have internet access are people in older age groups and even here we see 96% of homes with at least two people over 65 having access.

So it would seem that in many cases, people are using the web to interact with their utility suppliers, however take up is not universal.

Source: ONS, Internet access: Households and individuals

The data shows that where there is only one person in the household over 65, connection rates drop to 80%, meaning that there is a large section of society that still needs paper billing.

There is a similar picture in households in extreme poverty and arguably these are the people who need the most assistance with things like billing to ensure continued supply.

When you consider that in the 12 months to May 2021 almost 30% of people in the 18-44-year-old bracket said they had fallen behind with household bills you can see that having a simple way to manage these would probably be helpful.

In this context, using Direct Debit as a regular and reliable payment method which enables customers to know exactly what they’re paying out each month will help with this management.

Will we ever get rid of cash?

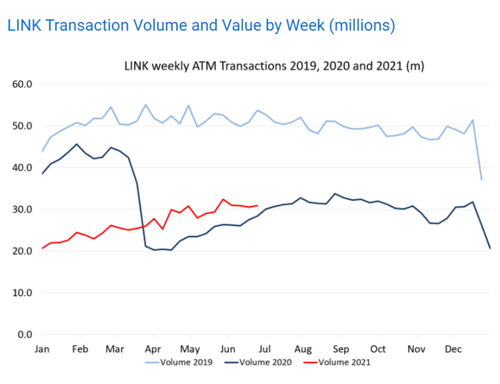

According to ATM organisation Link, cash withdrawals dropped from £2.4bn a week in the UK during 2019 to £1.4bn during the 2020 lockdown. However, 2021 has seen something of a recovery to £1.58bn in June.

This suggests that whilst the COVID pandemic did suppress the need for cash, it didn’t wipe it out altogether.

Older people and people in extreme poverty prefer cash and often find that this makes managing their money easier. The trend for digital payments is certainly upwards but if we don’t see the end of cash during a global pandemic then it is difficult to see when we will get to this point.

The mass take up of things like Direct Debit and Continuous Payment Authority (CPA) methods shows that people enjoy being able to set up their utility payments and then forget about them.

But at the moment, access to these is not universal and the continued use of cash in society together with a need for traditional paper-based billing makes it difficult to see all utility companies go paperless any time soon.

But the arrival of the newer energy companies shows that certainly, parts of the system can be fully paperless and that consumers won’t necessarily reject this as long as it is matched with excellent customer service.

The paperless utility company

So will we ever get fully paperless?

The rising rates of connectivity and the demographic changes means that a very high proportion of society has the ability to use digitised billing and payment services.

But as we have seen, even during the pandemic, people still used cash and it is difficult to see that attachment disappearing any time soon.

There will always be people who are unable to use a digitised service and so for them some utility providers are not suitable and it does beg the question what would happen if all providers were paperless?

It is distinctly possible that in the future, companies will need to provide some other method for people who are not able to use the web to access payment facilities and the regulators such as OFWAT may make that a licensing condition.

It will be interesting to see the innovations that take place in the sector to give people access in the future.