Access support trivial to technical

Access provide timely support and help get the right answers as efficiently as possible. Kate Burchell was a great engineer in assisting with multipl…

Open Banking Payments

Open Banking Payments

Open banking, also known as pay-by-bank, is revolutionising the way customers and consumers make payments. It allows individuals to pay directly by bank transfer from their bank to another business or organisation’s account.

Open banking is gaining traction, with more than 1 in 9 UK consumers and 17% of small businesses utilising open banking services in 2023. This innovative approach to payments serves as an alternative to traditional methods such as cards, Direct Debits, and standing orders.

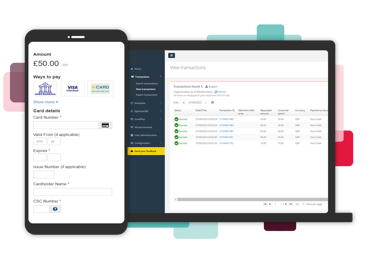

Open banking payments offer a fast and secure way to make transactions without the requirement to input card details. Customers can conveniently select their bank from a list and authorise their purchase, streamlining the payment process. This method not only enhances speed and security but also provides a seamless and efficient way to conduct financial transactions.

The use of open banking payments facilitates quicker fund transfers, reduces the risk of errors and fraud, and simplifies the payment process for both consumers and businesses. Additionally, this method empowers users to manage their finances more effectively and gain greater control over their transactions.

Payments per month

UK population use open banking

Open banking payments in 2022

Open banking year on year growth

Our open banking payments transfer funds direct from the customer’s bank to your bank account, which means there’s no card networks or expensive card processing fees. There’s no charges on failed or declined transactions, no chargebacks, just real time payments.

Unlike using cards, open banking payments offer a more secure way to pay. With open banking, customers verify each payment directly with their bank, which helps reduce fraud and unauthorised transactions. Plus, because open banking doesn't involve sharing banking data or processing card details, there's no need to worry about PCI DSS compliance costs.

Whether your customers are making payments online by themselves or through a contact centre, you can provide a pay by bank option. By offering multiple payment methods for online bills, invoices, or reminders in real time, you can increase successful transactions and decrease the number of abandoned carts.

Our partnership with Access enabled us to integrate open banking solutions that streamline transactions, ensuring payments are reflected in real-time on our customers' accounts. This shift not only enhances convenience, but also improves security, allowing our customers to complete their payment journeys effortlessly, whether through our contact centre or via bespoke payment links. The result is a straightforward, secure payment experience that aligns with modern expectations, making payments as simple as a click or a tap.

Customers can make a self-service payment online by selecting the 'pay by bank account' option, as an alternative payment method to using a debit or credit card. Learn more

Our 'payment request' option is available within our contact centre payments product and uses open banking to provide choice and enhance your customer payment experience. Find out more

Settlements are automated, reducing human error and there are no interchange fees so you can reduce your payment overheads.

As open banking continues to reshape the payments landscape, our platform remains at the forefront of innovation, delivering advanced payment solutions that cater to the evolving needs of modern businesses and consumers.

Explore the possibilities of open banking payments and elevate your payment experience with Access PaySuite.

As the experts, we’re on hand to help you manage your payments across our range of hassle-free solutions.

Simplify recurring payments with our reliable and flexible direct debit solutions. Automate billing processes and enjoy hassle-free collections, ensuring a steady cash flow.

Simplify cross-border transactions with our SEPA Direct Debit solution. Automate recurring payments, enhance cash flow, and reduce admin overhead. Offer customers a convenient, reliable payment method across 36 SEPA countries for increased loyalty.

Seamlessly integrate our online payments solution into your e-commerce platform. Offer your customers a secure and convenient way to make purchases, increasing conversion rates and customer loyalty.

Enable your customers to make payments on their own terms with our on-demand payments solution. Whether it's for services, subscriptions, or purchases, our platform ensures a smooth and instant payment experience.

Deliver a consistent payment experience across multiple channels with our omnichannel payments solution. Seamlessly integrate online, in-store, and mobile payments, providing your customers with flexibility and convenience.

Embrace the future of banking with our open banking payments solution. Harness the power of APIs to securely connect with your customers' bank accounts, enabling fast and secure transactions.

Simplify in-person transactions with our face-to-face payments solution. Whether it's through a traditional point-of-sale system or a mobile device, our platform ensures secure and efficient payment processing.

Take full control and make your outgoing payment transfers accurately and efficiently, with one of the most secure and trusted payment methods.