SEPA Direct Debit

SEPA Direct Debit

SEPA Direct Debit payments collection solutions

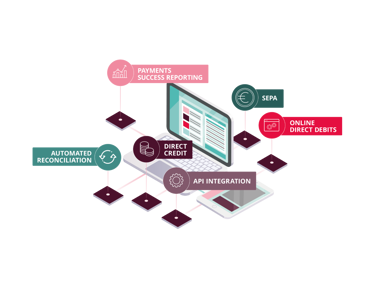

Revolutionise your European payments with our cutting-edge SEPA Direct Debit solution. Our service offers seamless transactions across 36 SEPA countries, reducing costs and enhancing cash flow predictability.

We provide Direct Debit services to leading organisations and businesses

Why choose our SEPA Direct Debit solution?

- Part of a comprehensive suite of payment solutions

- Tailored for midmarket sized businesses across a variety of sectors

- Unmatched customer support with dedicated account managers

Key features

Seamless integration

-

Easy setup with your existing systems

-

Compatible with popular accounting and CRM software

Flexible pricing

-

Transparent, competitive rates

-

Customisable plans for your business needs

Enhanced security

-

Bank-grade encryption

-

Tools available to help prevent fraud

-

Compliance with latest regulations

Automated reconciliation

-

Real-time payment tracking

-

Automated matching and reporting

Multi-currency support with SEPA: Seamless euro payments across Europe

With Single Euro Payments Area (SEPA), you can effortlessly collect payments in euros from customers across the European Union and select non-EU countries. Here’s what you can expect:

-

Fast and secure transactions: Customers can make cashless euro payments through credit transfers and direct debits, ensuring a smooth and efficient payment experience.

-

Broad coverage: SEPA allows for easy transactions throughout the EU and various non-EU nations, treating cross-border payments just like local ones.

-

Harmonised standards: Our SEPA integration eliminates the complexities of national versus cross-border payments, providing a consistent and reliable payment process for all participating countries.

-

Proven efficiency: Fully implemented since 2014 in the euro area (and by 2016 in non-euro SEPA countries), SEPA has transformed the way businesses handle payments, enhancing competitiveness and efficiency.

While we primarily bill in GBP, our commitment to providing exceptional payment options ensures that your customers can transact with ease and confidence.

How SEPA Direct Debit Works

Mandate setup

- Customers provide authorisation to merchants.

- Mandate information is securely stored.

Payment initiation

- Merchants submit payment requests to their bank.

- The bank forwards the request to the customer's bank.

Pre-notification

- Customers will be informed automatically about up coming debits.

Fund Transfer

- The customer's bank debits the account.

- Funds are transferred directly to the merchant's account.

Confirmation

- Merchants receive payment confirmations.

- Customers see the debit on their bank statements.

Refund window management

- Core Scheme: 8-week refund window for authorized transactions.

- B2B Scheme: No refund rights for authorized transactions.

Dispute resolution

- Customers can dispute unauthorised transactions for up to 13 months.

Industries we serve

Ready to transform your payment processes? Sign up for a demo or speak with our sales team today.

Why trust us?

Access PaySuite processes more than 289m transactions a year, with a total transaction value of more than 113bn. Our +56 NPS score demonstrates our commitment to first-class customer service.

-

20+ years of industry experience

-

5,000+ satisfied customers

-

FCA regulated as an authorised payment institution

-

Bacs Approved Bureau accreditation

-

G-Cloud 12 technology partner

-

+56 NPS score

Every payment made easy

As the experts, we’re on hand to help you manage your payments across our range of hassle-free solutions.

Frequently Asked Questions

What are SEPA Direct Debit mandates?

SEPA Direct Debit mandates are authorisations given by payers to payees that allow for the automatic collection of payments from the payer's bank account on a recurring basis. These mandates must include specific information, such as the names and addresses of both the payer and payee, bank account details, and the type of mandate (CORE or B2B).

What is the typical timeline for a SEPA Direct Debit transaction?

14 days before payment: Prenotification

The creditor sends a prenotification to the debtor, informing them about the upcoming direct debit.

1 day before payment (D-1): Preparation of transactions

The creditor prepares and submits transactions to their bank before the cut-off time.

Payment day (D): Due date

This is the date when the direct debit is processed. If the due date falls on a non-banking business day, it moves to

Up to 5 Days After Payment (D to D+5): Processing and initial settlement

The transaction is processed through the banking system, and initial settlement occurs.

Up to 7 Days After Payment (D+5 to D+7): Returns settlement

The latest date for settlement of returns is seven business days after the settlement date of the collection presented to the debtor's bank.

Up to 8 weeks after payment (D to D+8 weeks): Refund period

Debtors are entitled to request a refund for any SEPA Direct Debit within eight weeks from the date on which the amount was debited from their account.

What types of failures can occur with SEPA Direct Debit transactions?

-

Soft Failures: Such as insufficient funds, which can be managed with automated retry mechanisms.

-

Hard Failures: Including chargebacks, where a customer disputes a transaction.

-

Technical Failures: Resulting from issues like invalid account information or incorrect routing details.

What are the different types of R-messages in SEPA Direct Debit?

-

Revocation: A request to cancel a collection before settlement.

-

Refusal: A claim from the debtor to reject a collection before settlement.

-

Reject: A collection that cannot be executed due to issues like invalid format or closed accounts.

-

Refund: A request from the debtor for a refund of an executed collection.

-

Reversal: A correction by the creditor for an erroneous collection.

-

Return: A collection that is diverted from normal execution after inter-bank settlement.

How can I resolve insufficient funds issues with SEPA Direct Debit?

If a SEPA Direct Debit transaction fails due to insufficient funds, our system automatically handles retry attempts to collect the payment. It is important not to forward the customer to the accounts receivable department, as our failure management tools can effectively address uncollected transactions.

What should I do if a chargeback occurs on a SEPA Direct Debit?

In the event of a chargeback, it is essential to engage with the customer directly rather than forwarding them to accounts receivable. Our system provides tools to manage chargebacks and minimise their occurrence, ensuring a smoother resolution process.

What are R-codes, and how do they relate to mandate failures?

R-codes are codes used to indicate the status of a SEPA payment, particularly for mandate failures. Examples include:

-

AC01: Incorrect IBAN

-

AC04: Closed account

-

MD01: Invalid mandate

These codes help identify specific issues that need to be addressed to ensure successful transactions.

How can I prevent technical failures in SEPA Direct Debit transactions?

To prevent technical failures, ensure that you are using accurate account information and correct bank routing details. It is also crucial to stay informed about SEPA regulations and guidelines. Our platform is designed to help you comply with these requirements and minimise the risk of technical issues.