Charting the course: Understanding payment trends in the financial sector in 2024

This guide, written for mid-sized financial services providers, including fintechs and lenders, building societies and credit unions, will look at customers’ relationships with their provider, including their expectations and any difficulties they’ve faced.

We’ll also compare it to our analysis of the financial services sector to see which firms are faring best when it comes to payment experiences.

This guide will cover

- Changing consumer behaviours

- Pulse of the nation: How do people want to pay for financial services?

- Get the basics right

- Failed payments and poor customer service continue to undermine positive experiences

- Security is critical

- People want choice

- Open Banking is growing – but some people are still sceptical

- Methodology

Ask a customer why they choose a financial services provider, and the quality of their payment systems isn’t usually the first thing that springs to mind. Instead, they’ll probably talk about customer service, online experiences, convenience and security – as well as rewards, competitive interest rates and fees on loans, credit cards and mortgages.

Yet without good payment processes, none of these services would be possible.

Instead, people would be left feeling frustrated because they cannot complete everyday transactions, like overpaying a loan, or paying a bill. They’d also be rightly angry and concerned if their personal details were ever compromised.

As well as making customers’ lives easier, better payment processes bring benefits to financial services providers too. They drive revenue, provide liquidity, prevent customers falling into bad debt, and support regulatory compliance. Frictionless payments also help to improve operational efficiency, which reduces the administrative burden on staff.

With consumers more willing to shop around, the stage is set for all types of financial services providers, such as building societies, fintechs, lenders and credit unions, to take market share.

Modern payment processes enable these firms to rival their bigger counterparts while playing to their strengths, such as a building society’s connection to its local community. Whereas once they’d have been held back by manual reconciliation and other excessive admin, they are now able to use payments technology to enhance every part of their service.

Payments can make or break someone’s experience with a business, and getting it right is even more important in a competitive market like financial services.

Changing consumer behaviours

We’re used to seeing people zap their smartphones or watches at the checkout in shops, or transfer money to friends via an app. We probably do so ourselves. And, for younger generations in particular, the idea of paying in a cheque or visiting a branch of a bank or building society might be completely alien to them.

This is reflected in industry research. Around 86% of adults now use online, mobile and/or telephone banking, and almost a third of adults are now registered for one or more mobile payment services. The proportion of cash payments now stands at 14% – down from 54% a decade ago.

Although this shift is good news for digital-only fintechs, others, including building societies and credit unions, usually have to consider the needs of a broader demographic of people, who may be older, vulnerable and/or less digitally confident. This means they need to provide an array of online and offline payment options to cater to all the ways people like to pay.

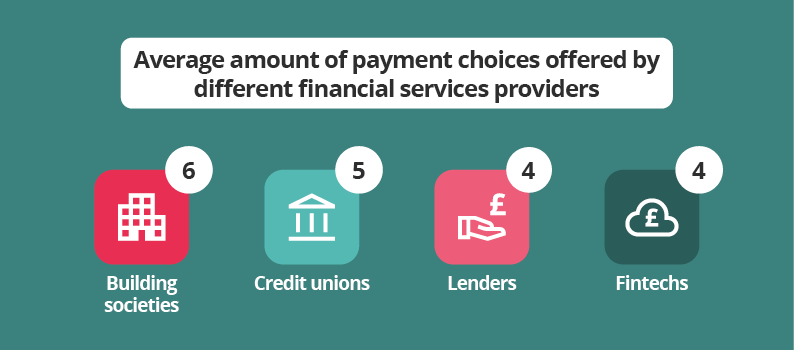

Our own research (see image) found that building societies list, on average, six out of 14 payment options on their websites – the most of any other type of provider. However, they are still only providing less than half of the options available, while credit unions are even lower at five.

We analysed the payment services of more than 200 UK financial services providers to determine which ones offered the widest range of payment services for paying for products like mortgages, loans and savings.

Included in the analysis were an equal split of businesses across the different verticals of financial services that Access PaySuite works with, namely fintechs, building societies, lenders, and credit unions.

As well as looking at the number of payment services being offered, we also looked at the types of services available. Once again, building societies led the way with just over 94% offering payment in-person by cheque, for example.

At the other end of the scale, fintech companies offered the fewest payment services. Only 10% state that they offer in-person cheque payments, 4% accept telephone payments, and none allow benefit deductions. While many fintech customers might be younger and digitally-savvy, there is a risk that they are excluding those who are vulnerable and/or on low incomes.

Choice and flexibility are clearly important to consumers who want to be able to choose the right payment option for their circumstances, or the type of transaction. While some people prefer to manage their finances entirely online, others prefer several different channels – and they expect a positive and consistent experience across them all.

Pulse of the nation: How do people want to pay for financial services?

We know that consumer behaviours and expectations have changed in recent years, especially in the wake of Covid-19 and the availability of digital payment tools.

To understand the impact of payment experiences, Access PaySuite surveyed a cross-section of consumers from across the UK. The responses shine a light on what’s important to consumers right now, their pain points, and which providers are best meeting their needs. We’ve compiled our findings below (please note, respondents could answer more than one question).

Key takeaways

- The importance of payment processes: Quick, frictionless payments are vital to meet customer expectations.

- Consumer behaviour is changing: Digital payment methods are as popular as ever, but financial services businesses need to consider the requirements of all customers.

- Avoid payments pain points to attract and retain customers: Safe and efficient payment processes are key, but customers dislike failed payments and poor customer service.

- Consumers expect choice: A variety of payment options, including Open Banking payments, is essential to meet customer expectations.

- Traditional banks continue to set the benchmark: Consumers prefer payment experiences with high street banking brands, but opportunities remain for other financial service providers.

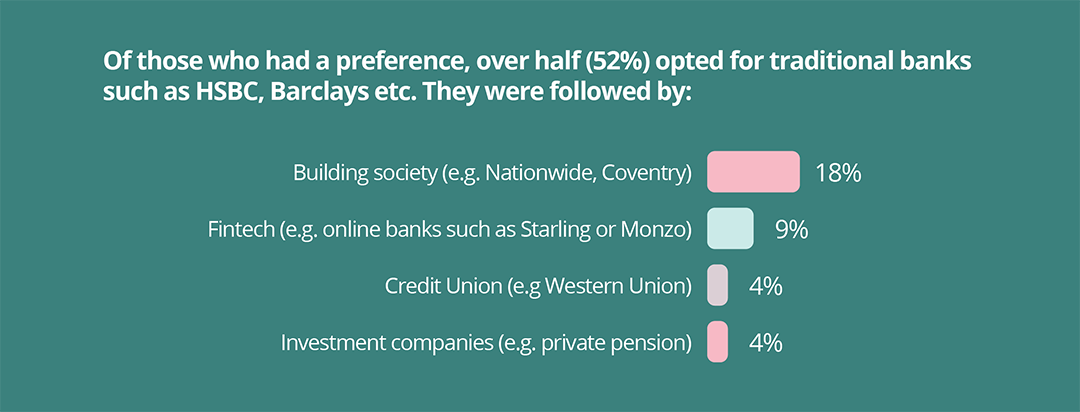

Traditional banks remain the preferred choice – but there are opportunities for other providers to take market share as younger consumers are more open to alternatives.

When asked what type of financial services firm best meets their payment needs, respondents overwhelmingly chose well-known high street banks over building societies, fintechs, credit unions, and investment providers. This highlights the dominance of major banks in the market, and the fact that they have evolved to offer more digital services.

However, delving into the details of the survey, we saw loyalty towards traditional banks start to wane in the younger age groups – suggesting they’re more open to other types of providers. Whereas 60% of the over-55s, and 54% of 45 to 55-year-olds would still favour a bank, this drops to 41% among 25 to 34-year-olds, and 32% among 18 to 24-year-olds.

Interestingly, the proportion choosing a building society remains broadly consistent across age groups, hovering at between 15-20% for each.

Get the basics right

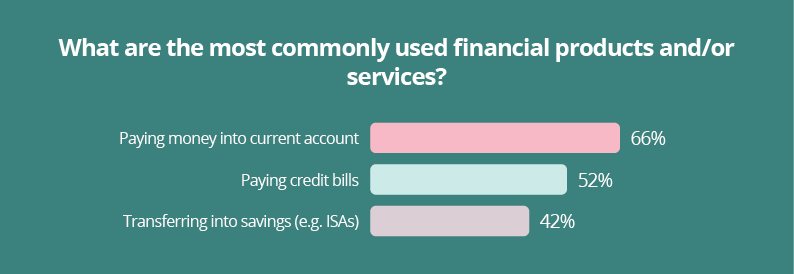

Our survey indicates that the most common reasons people engage with financial services businesses is with their bank or building society to make everyday transactions such as bill payments and transferring funds. Over a quarter (26%) of financial services users utilise their provider to pay their mortgage, while 23% are using the service to contribute to their private pension. By ensuring efficient handling of these fundamental tasks, companies can significantly enhance customer experiences, accommodate diverse needs, and stand out from competitors.

Across all age groups, a mobile app was the most popular method for paying money into a current account, although it was highest among 24-34-year-olds at 29%, followed by 35-44-year-olds at 28%.

When asked how they prefer to pay for their loans, over half (52%) of respondents pointed to Direct Debit. In second place, but a long way behind, was online card payment (debit or credit card) at 17%, followed by using the provider’s app at 10%.

Unsurprisingly, Direct Debit also came out on top for mortgage repayments (70%) and paying into a private pension (41%). Direct Debit has been around for decades – yet it remains the best way for customers to ensure payments are made and received on time and in full. The technology powering Direct Debits has evolved too in recent years, making it easier for firms to manage the process, collect data and ultimately reduce the risk of failed payments.

However, for other transactions, respondents preferred other payment methods over Direct Debit. An online card payment is the most popular way to pay a credit card bill (29%), perhaps because it allows consumers to choose how much they pay each month, while 23% of respondents would rather pay money into their current account using their provider’s app.

Ready to set up fast and simple Direct Debit payments?

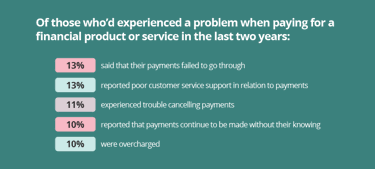

Failed payments and poor customer service continue to undermine positive experiences

Failed payments are frustrating for today’s consumers, who are used to efficient and easy-to-use tools in other areas of their lives, such as apps for retail, ecommerce, takeaways and taxis.

Those who experience payment problems must take time out of their day to contact their financial services provider and are unable to make use of their chosen product or service until the issue is resolved. It could even cause them to default on a payment and damage their credit score. Worse still, our survey suggests that people may not be able to resolve their issue quickly due to poor customer service in relation to payments.

Security is critical

When it comes to choosing a financial services provider, payments security emerged as the top priority for many people. A significant 40% of respondents highlighted the importance of having confidence in the secure handling of payments when making their decision about a financial services provider.

Ensuring compliance with relevant legislation, including data protection, is vital for building trust and reassuring existing and potential customers that their sensitive information is safe.

People want choice

Our previous analysis showed that the most payment options consumers can expect from a provider is six out of 14, offered by building societies. While fintechs will naturally focus on digital, the survey revealed that consumers value choice. Indeed, 28% said they’d choose a provider solely based on the choice of payment options.

This can be a challenge for building societies and credit unions in particular because all channels, including branches and telephone, require investment. However, it’s possible to deliver a range of services with strategic investment in automation to reduce costs and free up resources for those that require a human touch like face-to-face transactions.

Open Banking is growing – but some people are still sceptical

Led by fintechs, Open Banking has been growing, with more than 58% of providers now offering this type of payment for financial services products, according to our analysis. This is well ahead of lenders, building societies and credit unions, with 42%, 17% and 11% of businesses respectively listing it on their websites.

Yet our survey of consumers reveals a mixed picture when it comes to adoption and attitudes towards Open Banking, which launched in 2018. Just over a third (34%) currently use it to make payments in financial services, while 22% would like to do so in the future. Around 16% haven’t used it and are reluctant to and 13% said they’d never use it, while 15% were unsure.

We also found that Open Banking is most likely to be used by the younger demographics – with 46% of 25-34-year-olds, and 37% of 18 to 24-year-olds using it to make payments. This contrasts with 26% in the over-55s category.

Read more: The state of open banking payments in the financial services sector.

Look out for our upcoming blogs, where we share our tips for better payment experiences, so you can differentiate your business from the competition, and look at the role of Open Banking.

Find out how Access PaySuite can help you to future-proof your payments processes.

Methodology

Research 1: Survey

Access PaySuite commissioned Censuswide to conduct a survey of 2,000 consumers from across the UK to understand their preferences and priorities when it comes to choosing financial services providers. Respondents were categorised by age group (18 to 24; 25 to 34; 35 to 44; 55+) and the gender split was 49% male and 51% female.

Research 2: Analysis of payment services

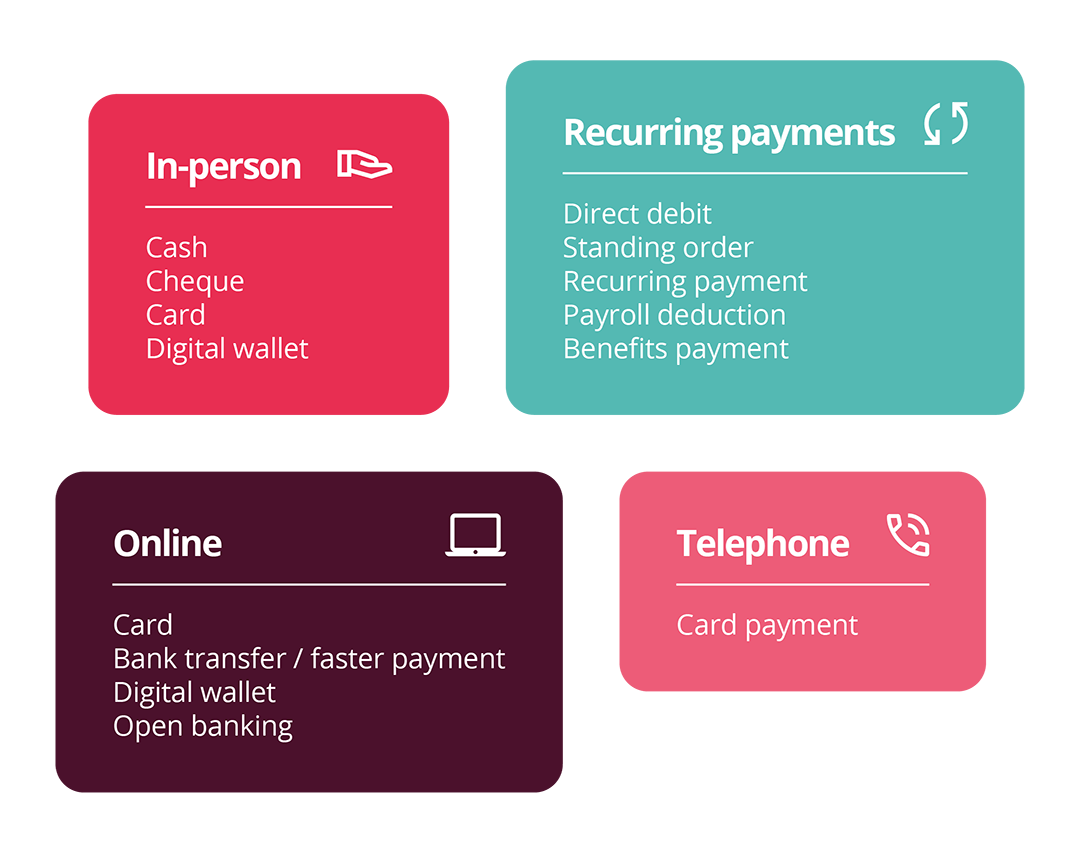

Alongside the survey, Access PaySuite analysed the payment options listed on the websites of a sample of 54 credit unions; 54 lenders; 53 building societies; and 50 fintechs in the UK in 2024. These were:

- In-person: cheque, card, digital wallet, cash

- Recurring payment: Direct Debit, standing order, recurring payment, payroll deduction, benefits payment

- Online: card, bank transfer/Faster Payments, digital wallet, Open Banking

- Phone: card