Impact of the cost-of-living crisis on eye care

At the end of 2022, the Association of Optometrists (AOP) released concerning data about UK consumers' reluctance to spend on their optometric needs. The AOP’s survey of over 1,000 individuals revealed alarming trends:

- 62% of respondents who wore glasses or contact lenses were delaying visits to their opticians.

- 31% admitted to using friends’ or family’s eyewear to save money.

- 36% continued to use out-of-date prescriptions.

These figures underscore the financial pressures consumers are under and the resulting impact on their eye care habits.

Adapting to changing consumer demands

In response to these trends, Access PaySuite, a payment solutions provider, conducted a study titled ‘How health and wellbeing businesses can cut costs and drive growth’. The study highlighted the importance of understanding and adapting to evolving consumer demands, particularly in the optometry sector.

Embracing diverse payment options

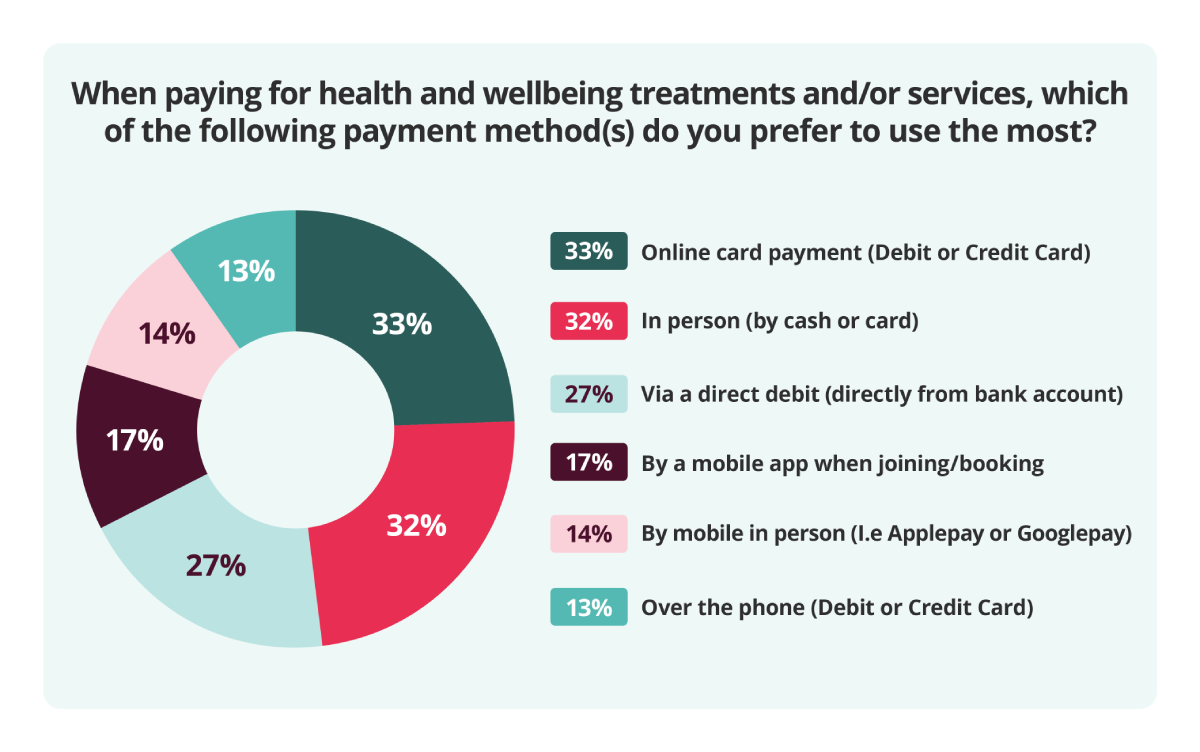

Access PaySuite conducted consumer research to find out just how important the payment journey is for health and wellbeing customers. The research showed a real mix of preferences, with a third (33%) of respondents wanting to pay online, a very similar amount (32%) wanting to pay in person, and then just over a quarter (27%) wanting automated payments in the form of Direct Debit.

Dave Carr, Transformation Director at Access PaySuite, emphasised the need for optometrists to offer a range of payment options. “Customer demands are changing rapidly,” Carr noted, warning that those who fail to adapt will likely see negative impacts on their bottom line. Optometrists must cater to varying financial capabilities by providing flexible payment methods, including instalment plans and online payment systems.

The impact of COVID-19 on payment behaviours

COVID-19 brought about significant changes in consumer payment behaviours, some of which may be here to stay. According to David Postings, Chief Executive of UK Finance, the pandemic accelerated existing trends, such as the reduction in cash usage and the increase in contactless and mobile payments.

For optometrists, adapting to these changes is crucial. Although online payment methods surged during the pandemic, Carr reminds us that a significant portion of the population remains digitally excluded. Thus, maintaining traditional payment options alongside digital ones is essential to ensure accessibility for all customers.

Generational preferences in payment methods

Generational differences also play a role in preferred payment methods. Access PaySuite’s report reveals:

- Nearly 30% of Generation Z (born 1997–2010) prefer online payments.

- In contrast, only 6% of the Silent Generation (born 1928–1945) listed online as their preferred payment method.

These statistics suggest that optometrists need to tailor their payment options to accommodate the diverse preferences across different age groups.

Strategies for success

To navigate these shifting trends, optometrists and opticians should consider the following strategies:

Flexible payment plans

Offering instalment plans and payment options that accommodate varying financial situations can help ease the burden on customers.

Offer multiple payment methods

Maintain a balance between traditional and digital payment methods to cater to both tech-savvy customers and those who are digitally excluded.

Customer-centric approach

Stay attuned to changing consumer expectations and be proactive in adapting systems and processes to meet these needs.

Conclusion

As Elon Musk famously said, “Some people don’t like change, but you need to embrace change if the alternative is disaster.” The UK eye care industry must heed this advice to thrive in an environment where consumer behaviours are rapidly evolving. By embracing flexible, customer-focused strategies, optometrists and opticians can continue to provide essential services while adapting to the challenges of a changing economic landscape.